How diversification can help achieve your long-term goals

Share

With signs that the economy could be reaching its cyclical peak, investors are being advised to prepare for a potentially long period of volatility. But what does ‘being prepared’ actually mean?

In the past, many pension schemes, for example, have relied upon the performance of equities to deliver their returns. However, challenging market conditions over the past few years have led to mixed investment performance, calling for investors to break away from their more traditional asset class models.

As discussed in our previous article, there are a variety of asset classes that investors can choose from. However, in light of recent market activity, investors are being advised to spread the risk across a number of these different markets, types of investment and companies in order to obtain more stable and robust returns at the same time as minimising risk over the long term.

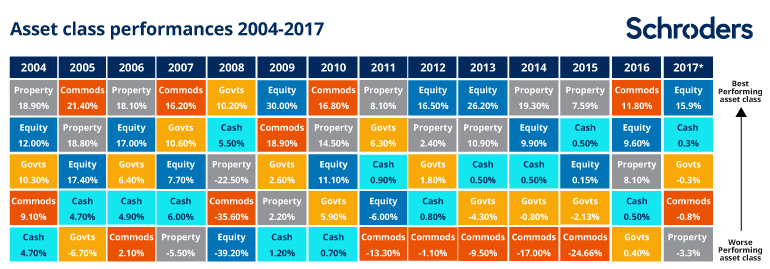

As the chart below demonstrates, it has become increasingly difficult to generate consistently positive returns by investing in just one market. In 2008, equities were the worst performing asset class yet, just one year later, they were topping the charts, making it very difficult to predict which class is the right one to choose.

Source: Schroders, Datastream as of 31 October 2017. Equity: MSCI AC World Total Return Index (local currencies); Property: UK IPD Index (sterling); Cash: 3 month Sterling LIBOR (sterling); Government bonds: Barclays Global Treasury Index (dollars); Commodities: Bloomberg Commodity index (dollars). All show total return either in local currency or currency of denomination. Please remember past performance is not a guide to future performance and may not be repeated.

Nathan Mead-Wellings, Director at Finura explains, “Whilst diversification can help reduce the overall risk of a portfolio, the key is to strike the right balance. Having a mix of asset classes, such as equities, fixed income, property and commodities, can help to compensate for each other when one particular investment isn’t performing as well; however, it’s equally important not to over-diversify with too many components, as this can dilute the results.

“Another important factor to consider is which combination of asset classes you choose. Over recent years, we have witnessed an increased correlation between certain traditional asset classes, meaning that if all of your investments are in the same class, there is the chance that they will all behave in a similar manner under certain market conditions. A properly diversified portfolio should include a blend of both UK and overseas asset classes and be spread amongst both traditional and alternative options.”

Investors are also being advised to take a longer-term view on their investments. When the market is receding, a natural reaction is to withdraw investments and move them somewhere else. However, many investors may be surprised to learn that a significant amount of investment performance is actually driven by the asset allocation itself, rather than where in the market cycle they acquired or disposed of the assets. By resisting the urge to move too soon when markets dip, and risk abandoning a well-diversified investment strategy, investors with diversified portfolios can reduce the ‘ups and downs’ usually associated with investing as the different asset classes work alongside each other to create or sustain wealth over the long term.

Nathan continues: “One of our main objectives at Finura is to demonstrate to investors how a diversified portfolio is capable of meeting their liabilities over time. We do this by balancing their longer-term objectives with shorter term considerations. The credit crisis, recent market uncertainty and talk of a forthcoming recession have made the issue of risk an increasing concern for our clients; however, by supporting our clients, educating them on behavioural finance and using market-leading cash flow modelling software, we can demonstrate how a long-term view can deliver the returns they are looking for.”

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources:

https://www.ftadviser.com/investments/2018/04/03/getting-the-diversification-balance-right/

https://www.pensions-pmi.org.uk/documents/potential-benefits-of-diversification/benefitsofdiversificationapril2012.pdf

http://www.schroders.com/en/uk/private-investor/insights/markets/14-years-of-investment-returns-historys-lesson-for-investors/

Share

Other News

Preparing For The Autumn Budget: What It Could Mean For Your Finances

The Autumn Budget is set for Wednesday 26 November 2025, when Chancellor Rachel Reeves will deliver her first full Budget statement.

Alongside the speech, the Office for Budget Responsibility will publish updated forecasts for the UK economy, giving us a clearer picture of the challenges and opportunities for the year ahead.

Using Lifestyle Modelling To Stress-Test Your Retirement Plan

Planning for retirement isn’t just about hitting a savings target — it’s about ensuring that the lifestyle you envision can be sustained throughout your later years.

Is Buy-to-Let Still a Good Investment in 2025?

For decades, purchasing property with the intention of renting it out was an appealing strategy for building wealth. There were several reasons why this was the case.