Who Should Be Responsible For Mitigating Climate Change?

Share

We can all ‘do our bit’ when it comes to caring for the environment. Recycling more, buying food from sustainable sources and reducing our carbon footprint. We all have a personal choice about where and with whom we spend our money.

But, when it comes to our investments, are the companies we are investing in also playing their part? In the latest Schroders Global Investor Study, results from over 23,000 investors across 32 locations worldwide revealed some interesting insights into investors’ views on how companies behave and who should be responsible for mitigating climate change.

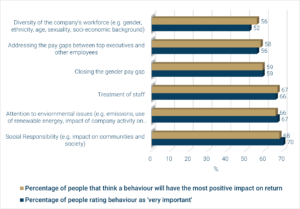

The behaviours investors care about most

It is likely that the impact of COVID-19 has played its part in how investors responded this year – since the pandemic really start to take its toll, it has been widely acknowledged that a sustainable recovery plan was going to be needed.

Interestingly, the behaviours people deemed to be the most important from a sustainability perspective are also considered the most impactful on returns.

Figure 1: Most important company behaviours vs most positive impact on return

Source: Schroders

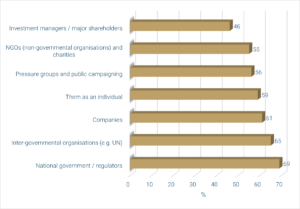

Who do people think should be responsible for mitigating climate change?

Questions have been asked about what Covid-19 could teach us about tackling climate change. The results show a wide spread of opinion on who needs to take responsibility, with a collaborative approach between all parties thought to be the best chance of making the biggest difference.

Figure 2: Who should be responsible for mitigating climate change?

Source: Schroders

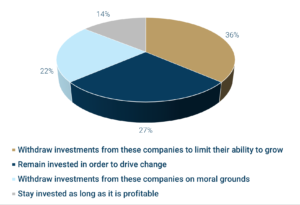

And what about Fossil Fuels?

While the above results show less than half of investors feel investment managers should be responsible for climate change, nearly 60% think they should withdraw from funds in the fossil fuel industry.

Figure 3: What should companies do about those involved in the fossil fuel industry?

Source: Schroders

Overall, the findings suggest that while investment professionals are not explicitly blamed for carbon emissions levels, they are expected to become more involved in reducing them. However it is also important for investors to understand the credentials of their own investments, to ensure they align to their own values.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Share

Other News

Preparing For The Autumn Budget: What It Could Mean For Your Finances

The Autumn Budget is set for Wednesday 26 November 2025, when Chancellor Rachel Reeves will deliver her first full Budget statement.

Alongside the speech, the Office for Budget Responsibility will publish updated forecasts for the UK economy, giving us a clearer picture of the challenges and opportunities for the year ahead.

Using Lifestyle Modelling To Stress-Test Your Retirement Plan

Planning for retirement isn’t just about hitting a savings target — it’s about ensuring that the lifestyle you envision can be sustained throughout your later years.

Is Buy-to-Let Still a Good Investment in 2025?

For decades, purchasing property with the intention of renting it out was an appealing strategy for building wealth. There were several reasons why this was the case.