A fair start to 2021

Share

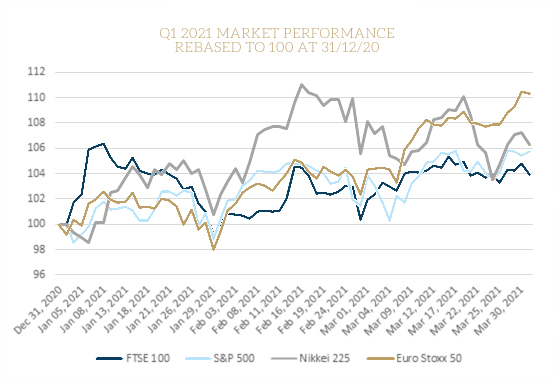

Global markets got off to a steady start in 2021 after the volatility of 2020.

After an interesting first quarter in 2020, one year on markets have had a much quieter first three months in 2021, as the graph above shows. The UK, as measured by the FTSE 100 appears to remain a laggard, but that ignores the recent strength of sterling. Allow for that and the 3.9% rise in the FTSE 100 is better than the MSCI All-World performance of 3.2% in sterling terms. Similarly, the standout 10.3% rise of the Euro Stoxx 50 on the graph drops to just 2.1% when adjusted for the change in £/€ exchange rate.

A summary of the movements in the main markets is shown below:

| 31/12/2020 | 31/03/2021 | Change in Q1 2021 | |

| FTSE 100 | 6460.52 | 6713.63 | 3.92% |

| FTSE 250 | 20488.3 | 21518.71 | 5.03% |

| FTSE 350 Higher Yield | 2893.08 | 3106.46 | 7.38% |

| FTSE 350 Lower Yield | 4291.83 | 4335.49 | 1.02% |

| FTSE All-Share | 3673.63 | 3831.05 | 4.29% |

| S&P 500 | 3756.07 | 3972.89 | 5.77% |

| Euro Stoxx 50 (€) | 3552.64 | 3919.21 | 10.32% |

| Nikkei 225 | 27444.17 | 29178.8 | 6.32% |

| Shanghai Composite | 3473.07 | 3441.91 | -0.90% |

| MSCI Em Markets (£) | 1767.417 | 1785.206 | 1.01% |

| UK Bank base rate | 0.10% | 0.10% | |

| US Fed funds rate | 0.00%-0.25% | 0.00%-0.25% | |

| ECB base rate | 0.00% | 0.00% | |

| 2 yr UK Gilt yield | -0.17% | 0.10% | |

| 10 yr UK Gilt yield | 0.19% | 0.85% | |

| 2 yr US T-bond yield | 0.12% | 0.16% | |

| 10 yr US T-bond yield | 0.92% | 1.75% | |

| 2 yr German Bund Yield | -0.71% | -0.70% | |

| 10 yr German Bund Yield | -0.57% | -0.30% | |

| £/$ | 1.3669 | 1.3797 | 0.94% |

| £/€ | 1.1172 | 1.1739 | 5.08% |

| £/¥ | 141.1299 | 152.4559 | 8.03% |

A few points are worth noting from this table:

The out-performance of the FTSE 350 Higher Yield over its Lower Yield counterpart is a reflection of the trend towards value. It is mirrored in the USA where the more heavily tech-weighted S&P 500 underperformed the Dow Jones Industrial Index by 2%.

Emerging markets were relatively disappointing in Q1, dragged down by China and rising US bond yields.

Increasing bond yields were a notable feature of the quarter. Although base rates were unmoved and 2-year Government bond yields little changed, 10-year yields rose sharply. There is now talk of the 2% barrier being breached for 10-year US Treasuries before the end of the year – more than double the starting level.

While the first quarter had its fair share of ups and downs, as the graph shows, the rise was more of a churn upwards than a straight trend. How long markets can continue to rise if bond rates continue to do the same is the point to watch in the coming three months.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Source: Techlink

Share

Other News

Preparing For The Autumn Budget: What It Could Mean For Your Finances

The Autumn Budget is set for Wednesday 26 November 2025, when Chancellor Rachel Reeves will deliver her first full Budget statement.

Alongside the speech, the Office for Budget Responsibility will publish updated forecasts for the UK economy, giving us a clearer picture of the challenges and opportunities for the year ahead.

Using Lifestyle Modelling To Stress-Test Your Retirement Plan

Planning for retirement isn’t just about hitting a savings target — it’s about ensuring that the lifestyle you envision can be sustained throughout your later years.

Is Buy-to-Let Still a Good Investment in 2025?

For decades, purchasing property with the intention of renting it out was an appealing strategy for building wealth. There were several reasons why this was the case.