5 ways to reduce your retirement age

Share

More than 12 million people currently receive the state pension.

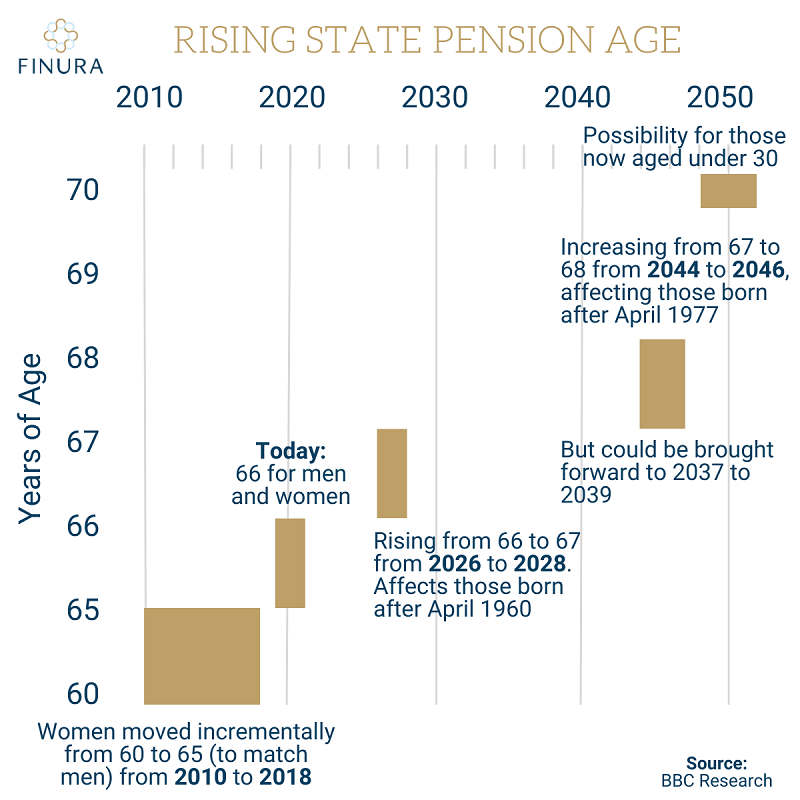

Men and women born between 6 October, 1954 and 5 April, 1960 start receiving their pension at the age of 66. But for people born after this date, the state pension age is increasing:

- a gradual rise to 67 for those born on or after 5 April, 1960

- a gradual rise to 68 between 2044 and 2046 for those born on or after 5 April, 1977

There had been speculation, in the run-up to the budget, that the second increase would be brought forward, however, the government has confirmed that it will not change the timetable at the moment and a decision is now expected in 2026, after the next general election. You can also use the government’s Pension Age Calculator to find out when you are eligible.

In addition, while the state pension age (SPA) has been “triple-locked”, meaning it will rise in line with whichever is highest of inflation, the average increase in wages across the UK or 2.5%, for some, an early retirement continues to seem out of reach. In April to June 2022, the number of people aged 65 years and over in employment increased by a record 173,000 on the quarter to 1.468 million, a record level.

However, with some careful planning and advice from a financial planner, you could help to reduce the age at which you are currently able to retire.

Here are five steps you can take to help improve your chances of retiring early.

Have a Plan

The first step is to work out the gap between when you would like to retire and your state pension age. From there you can begin to calculate how many years of ‘missing’ income you will face by retiring ahead of your SPA and how much money you need to save to achieve a suitable monthly income in retirement. Be sure to account for any potential unforeseen circumstances too, such as an inability to work for as long as you hoped and changes in investment returns on savings, taxation and inflation.

Embrace Auto-enrolment

Whilst having to sacrifice 5% of your current monthly income may seem steep in some people’s eyes, using your workplace pension scheme to save every month will bring a welcome boost to your pension pot further down the line. With a 3% contribution made by your employer and tax relief on top, you could be missing out on vital additional capital by not signing up.

Save as much as you can afford to

Everyone has an annual pension allowance of 100% of their salary or £60,000, whichever is lower, except those with an income above £200,000, when the allowance is reduced to £10,000. When you pay into a pension, some of the money that you would have paid in tax on your earnings goes into your pension pot rather than to the government. Tax relief is paid at the highest rate of income tax you pay, so for a basic rate taxpayer this is 20%.

You also have a £20,000 ISA limit each year – whilst you do not get a tax refund when you pay into an ISA, your investment is protected from tax, so you do not pay any tax on the interest you earn.

Start early

When we are young it can be difficult to think ahead to what our golden years will look like, however, the earlier you start saving the less it will cost you to retire early. This is due to the effect of compound investment returns over time combined with the additional contributions you can make into various tax wrappers by putting money aside earlier in your career.

Check your NI Contributions

The maximum state pension is available once 35 years of NI contributions have been made. Those reaching SPA after 2051 will automatically qualify however those born before 1983 could get less or more in total due to the new transitional SPA arrangements noted above. You can request a forecast of your state pension online and, if it comes up short, consider paying in extra voluntary contributions.

At it stands, you can sometimes pay for gaps from more than 6 years ago, depending on your age.

If you are a man born after 5 April 1951 or a woman born after 5 April 1953, you have until 31 July 2023 to pay voluntary contributions to make up for gaps between tax years April 2006 and April 2016 if you’re eligible.

After 31 July 2023, you’ll only be able to pay for voluntary contributions for the past 6 years. This may not be enough to qualify for a new State Pension if you have fewer than 4 qualifying years on your National Insurance record. You’ll usually need at least 10 qualifying years in total.

With the new pension freedoms also allowing us to dip into our private pension pots from age 55, workers now have the option to start drawing a private pension while they are still working. For example, should you wish to reduce your working hours as you get older, you could support your income by making withdrawals from a private pension until your state pension kicks in to fill the gap.

For more advice about planning for the future and how you could boost your pension funds, please contact a Finura planner.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: https://www.telegraph.co.uk/pensions-retirement/financial-planning/ultimate-guide-beating-state-pension-age-rise/, https://www.ons.gov.uk/employmentandlabourmarket/peopleinwork/employmentandemployeetypes/articles/peopleaged65yearsandoverinemploymentuk/januarytomarch2022toapriltojune2022 and https://www.bbc.co.uk/news/business-54421662.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.