A look back at 2022 inflation numbers

Share

Inflation hit the highest level in 40 years in 2022, but what actually drove up the rate and can it come down?

The CPI annual inflation reading for December 2022 was 10.5%, 0.6% below the 11.1% peak it hit in October and the fourth consecutive month in double digits. What was behind the change from 5.4%, twelve months previously and will the Prime Minister’s recent pledge to halve inflation by the end of 2023 be met?

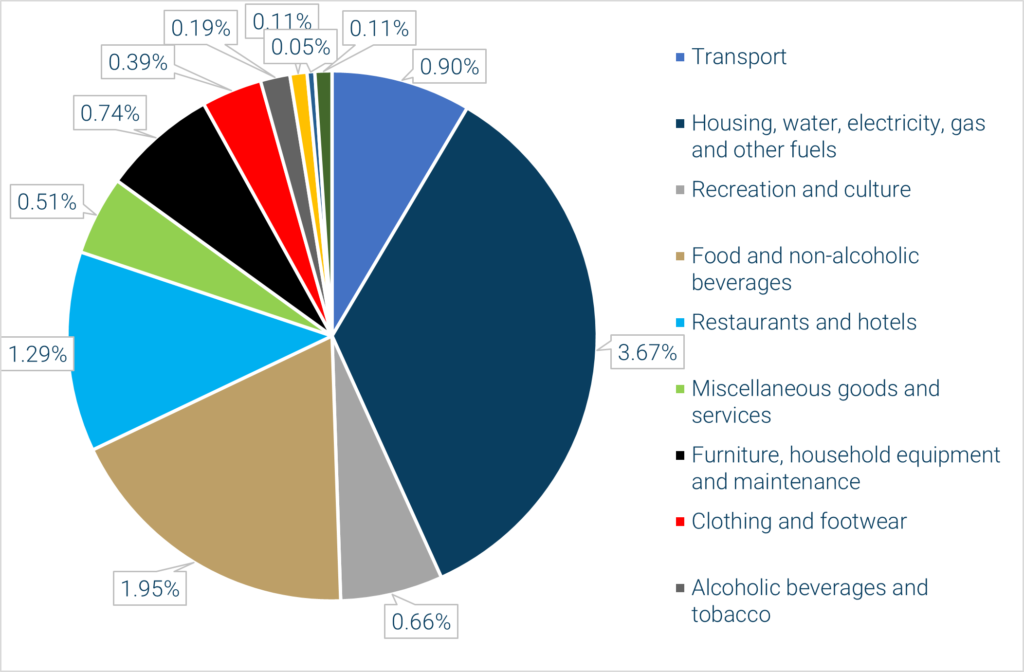

One way to gain an insight is to look at how much contribution each of the twelve groups in the CPI shopping basket made to the final figure. This involves considering two aspects:

- The weighting for the group in the index – For example, the largest group is Transport, which accounts for 13.9% of the basket. The smallest is Health, which counts for just 2.5%

- The inflation rate for each group – In 2022 that ranged from 26.6% for Housing, water, electricity, gas and other fuels to just 2.0% for Communications

Multiply each group’s weighting by its inflation rate and the product is the contribution to overall inflation. In graphical from, the result is shown in the pie chart above. In tabular form, it looks like this:

| Group | Weight% | Inflation % | Contribution % |

| Transport | 139 | 6.5 | 0.90% |

| Housing, water, electricity, gas and other fuels | 138 | 26.6 | 3.67% |

| Recreation and culture | 134 | 4.9 | 0.66% |

| Food and non-alcoholic beverages | 116 | 16.8 | 1.95% |

| Restaurants and hotels | 114 | 11.3 | 1.29% |

| Miscellaneous goods and services | 94 | 5.4 | 0.51% |

| Furniture, household equipment and maintenance | 76 | 9.8 | 0.74% |

| Clothing and footwear | 60 | 6.5 | 0.39% |

| Alcoholic beverages and tobacco | 50 | 3.7 | 0.19% |

| Education | 33 | 3.2 | 0.11% |

| Communication | 25 | 2.0 | 0.05% |

| Health | 21 | 5.1 | 0.11% |

| TOTAL | 10.56% |

What stands out in both chart and table is the contribution of the Housing, water, electricity, gas and other fuels group. It represents 13.8% of the shopping basket but accounts for just over a third of CPI inflation. The main culprits within the group are the predictable pair:

- Gas, with annual inflation of 128.9% and a 1.4% weighting in the overall index; and

- Electricity, with annual inflation of 65.4% and a 2.0% weighting in the overall index.

Air travel also recorded a 44.1% annual increase, but only accounts for 0.2% of the overall index while liquid fuels (primarily heating oil) rose 47.1%, with a weighting of 0.1%.

The major contribution from domestic energy bills is one reason why Mr Sunak’s pledge is in reality no more than a statement of the current economic consensus. Wholesale gas prices are now falling and there are predictions that by October 2023 the Ofgem price cap will be about £2,700, ie less than the post-April £3,000 Energy Price Guarantee announced in the Autumn Statement. Even if electricity and gas inflation were 20% in 2023, that would make a contribution to the overall CPI of 0.6% rather than last year’s 3.1%. The result is 2.5% off the overall CPI rate, despite a significant price rise.

A similar argument applies to other areas with sensitivity to energy costs, such as transport. Provided that price rises in 2023 are not as fierce as in 2022, then year on year inflation will fall. A good current example of thee effect is the fuel and lubricants sub-category of transport, which reacts quicker to energy costs than do utility bills. The annual fuel and lubricants inflation was 43.7% in July 2022, but it ended the year at 11.5%.

Conclusion

Gas prices were the driver of 2022’s inflation, both as an energy source (it effectively sets the marginal cost for electricity) and as a chemical feedstock, e.g. in fertilisers. Bar another Ukraine-level shock, gas will not be a repeat problem of the same scale in 2023. The issue for the Bank of England, with its 2% inflation target, changes in 2023 from something it cannot control – energy prices – to something in theory it has some power over – wages. The risk of a wage/price spiral, with earnings currently growing by 7.2% a year in the private sector, is clear. Core CPI inflation (CPI excluding energy, food and alcohol) is 6.3% and the Bank may feel it has little option but to engineer a recession to drive that figure down.

If you would like to discuss the above in more detail, please contact us here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: Techlink

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.