Base rate rises to 0.75 percent

Share

To nobody’s surprise, the Bank of England has made its third consecutive increase in base rate, taking it up to 0.75%.

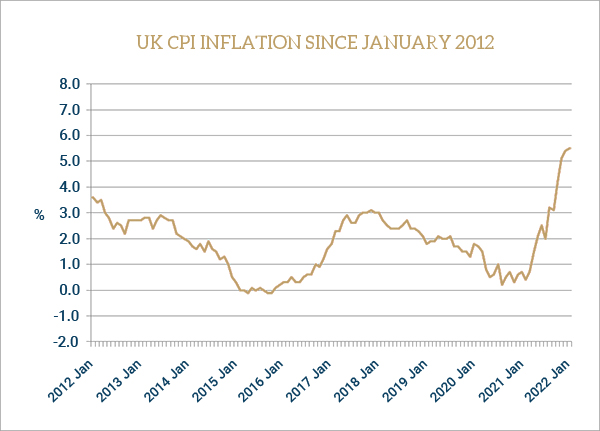

In some ways Thursday’s decision by the Bank of England was driven by the same factors as Wednesday’s 0.25% increase by the Federal Reserve. The Bank of England, like the Fed, is looking at a current inflation rate that was last seen in the 20th century and is feeling, to put it mildly, behind the curve. The Bank was not as openly a member of the transitory camp as the Fed, but was certainly a fellow traveller throughout most of 2021. Now, again echoing the Fed, it is playing catch up. However, unlike the Fed there are only words, not dot plots, to provide a greater insight into where the Monetary Policy Committee (MPC) sees the future rate path heading.

The newly announced base rate of 0.75% takes the Old Lady back to where she was between August 2018 and the start of the pandemic in March 2020. A further 0.25% increase will take her back almost another decade, to February 2009.

The Bank now projects that inflation will rise ‘to around 8% in 2022 Q2, and perhaps even higher later this year’ when the utility price cap resets in October. The Bank does not put a figure on this later peak, given that the utility cap will be driven by market prices between February and the end of July. However, it does note that ‘if sustained, the latest rise in gas and electricity futures prices would mean that price caps, when reset in October 2022, could be around 35% higher’, implying another £1,000 added to annual bills.

Despite the short term gloom, the Bank says ‘Further out, inflation was expected to fall back materially, and possibly to a greater extent than had been expected in the February Report, as energy prices stopped rising and as the squeeze on real incomes and demand put significant downward pressure on domestically generated inflation.’ In other words, the Bank sides with the ‘…the expectations of professional forecasters, [that] had remained close to the 2% target at the two to three year ahead horizon.’

In terms of future interest rates, the Bank seems to be making an each-way bet. As usual, its inflation projections are based on interest rates following what the market is implicitly predicting, which is for a base rate of around 2% by the end of the year. There are six more MPC meetings in 2022, which would suggest the market is expecting for all but one meeting to produce a 0.25% increase. However, the MPC appeared not to have such a heavy foot on the rate pedal, ‘…the Committee judged that some further modest tightening in monetary policy might be appropriate in the coming months, but there were risks on both sides of that judgement depending on how medium-term prospects for inflation evolved.’

Some commentators are suggesting that, despite those money market projections, the Bank could bring rates up to 1% at its May meeting and then pause for fear of what further hikes will do to inflation-hit economic growth.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: Techlink

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.