Emergency Tax and Lump Sum Withdrawals Following Pension Freedoms

Share

Since income drawdown was introduced in April 2015, savers now have access to new ways to withdraw and spend their pensions. While the government has focused on highlighting the benefits, such as the opportunity for people to keep pension pots invested and use them flexibly to dip into when they choose, the tax system is telling a different story.

Those opting to take advantage of the 25% tax free lump sum withdrawal are being judged by HMRC as if they were starting the first of a monthly withdrawal plan. Upon drawing down this initial payment, the tax system assumes they are going to continue to take that amount every month for the rest of the year. This prompts an emergency tax rate to be applied, that not only pushes savers up into higher tax bands, but removes their tax free personal allowance.

In cases where savers are withdrawing particularly large amounts, for example to clear off a mortgage or help family members with a property deposit, the amount of emergency tax being taken is so large that they are left with little money remaining on which to live until the tax code is adjusted and a refund issued by HMRC.

Whilst HMRC will eventually amend the tax code, so that all future payments are taxed correctly, those who have been subject to large overpayments, and cannot afford to wait until tax year end for their adjustment refund, are having to reclaim the money using an appropriate claim form.

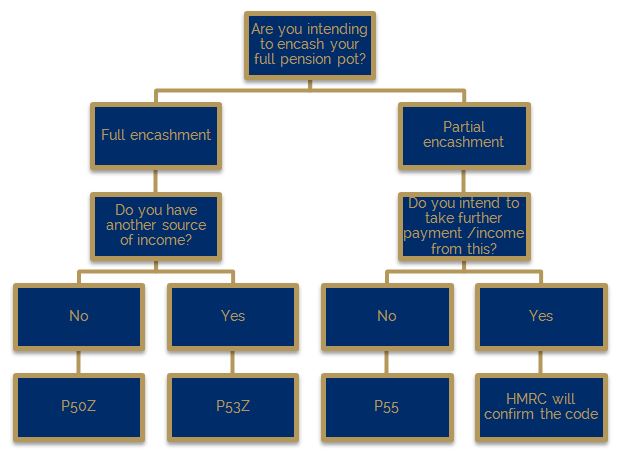

There are 3 forms available for reclaiming overpaid tax as the result of a lump sum pension payment and savers have been advised to seek advice as to which route is best to follow.

As advisers we can guide our clients towards the correct form by asking 3 basic questions:

1. Have you encashed the full value of your pension fund or only some of it?

2. Do you have other source of income during the tax year in question?

3. Are you intending to make further withdrawals from the pension plan in question?

If you would like to know what tax you may have to pay upon taking a lump sum from your pension, please speak to your Finura Partners adviser.

Sources: http://www.thisismoney.co.uk/money/pensions/article-2966766/Savers-using-pension-freedom-warned-pay-emergency-tax.html and http://adviser.royallondon.com/pensions/technical-central/information-guidance/benefit-options/emergency-tax-and-lump-sum-withdrawals/

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.