Every Cloud Has A Silver Lining

Share

“Whether we’re talking about socks or stocks, I like buying quality merchandise when it is marked down.” – Warren Buffett, CEO of Berkshire Hathaway.

Glass Half Full vs Glass Half Empty

While investor pessimism is at its highest in 20 years [1], and the media continues to highlight a melancholy scenario for our economy, due to inefficient pricing and fear in the market, bear markets can actually present opportunities for investors. Since 1987, the S&P 500 Index has seen double-digit gains 85% of the time after extremely pessimistic sentiment [2]. So instead of thinking of how bad the market is doing, investors may be better off thinking of the market as being significantly less expensive.

Nothing Lasts Forever

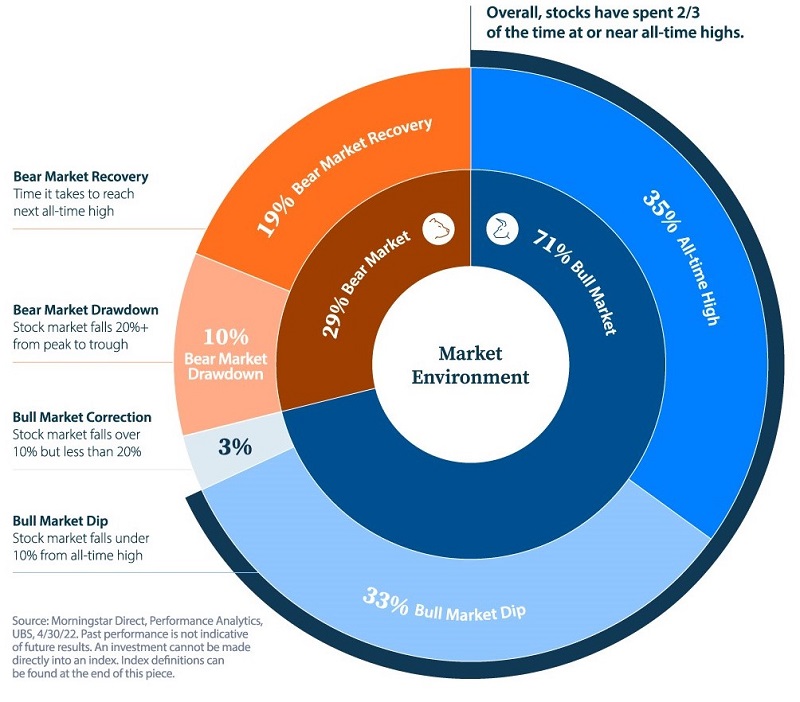

While bear markets can hurt when we see our investment values falling, in reality, they only account for 29% of the market environment, with bull markets making up the majority share (71%). As the chart below shows, overall, stocks have spent around two-thirds of the time at or near all-time highs.

Look to the Future, Not the Here & Now

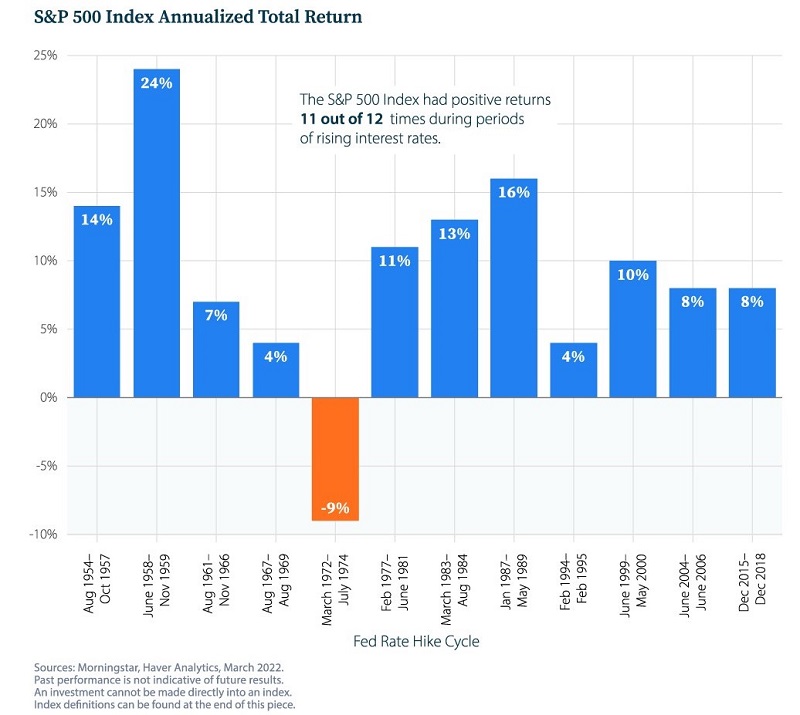

As we have always championed at Finura, a long-term approach to investing is key – despite the short-term impact that inflation, interest rates and investor sentiment can have on the market, stocks often weather the storm. Just as bear markets can promote investor uncertainty, rising interest rates can also cause stock market disruption. However, since 1954, the S&P 500 Index has returned an average 9.4% annually during Fed rate hike cycles. Furthermore, as the chart below demonstrates, the S&P 500 Index has had positive returns 11 out of 12 times during periods of rising interest rates.

In summary, while bear markets can incite pessimism and fear, they are usually short-lived. By considering a contrarian point of view, and learning from historical market cycles, there is always a bright side if you look for it.

If you would like to discuss any of the above in more detail, please contact your financial planner here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: Visual Capitalist, [1] AAII survey and [2] Bloomberg 5/12/22.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.