Why you should act now to benefit from existing pension contribution allowances

Share

In his second budget in less than four months, on 8 July George Osborne is set to announce a new wave of austerity measures, pledging a budget that will be ‘for the working people’. Yet for those high earners, wanting to utilise the £40,000 annual allowance, they may wish to make pension savings sooner rather than later, just in case this initiative comes into effect immediately after the budget.

What is being proposed?

The budget aims to set into motion the Conservative’s plans to raise £1 billion, which will fund plans to make more family homes exempt from inheritance tax (if they are left to children or grandchildren) and double the amount of free childcare given to three and four-year olds in England to 30 hours a week.

The money will be raised through a reduction in tax relief on pension contributions for those people earning in excess of £150,000 per annum.

Under the new regulations, it is intended to taper the pension savings annual allowance from £40,000 pa (earnings at £150,000) to £10,000 pa (earnings at or more than £210,000). What this means for a client is for every £2 they earn over £150,000, their pension annual allowance will reduce by £1.

The lifetime allowance is also set to come down to £1million from £1.25million.

Example

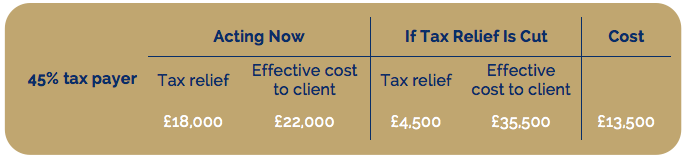

A client earning £210,000 per annum wants to make a total pension contribution of £40,000 in their current pension input period.

For those clients who may not have capitalised on their full allowance in the previous three years, there may be the opportunity to make pension contributions in excess of the £40,000 annual allowance and receive further tax relief (provided you were a member of a registered pension scheme and make the maximum allowable contribution in the current tax year).

If you would like to discuss the possibility of bringing forward any planned pension contributions for this tax year, contact your Finura advisor today.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.