Higher Rate Taxpaying Is A Growing Club

Share

As tax rate band thresholds are changing, understanding the impact on high rate taxpayers and the economy is crucial. Join us as we look back and explore the changing landscape of income tax rates and what you can do.

If we cast our minds back to the early 1990s, John Major was Prime Minister and his successor as Chancellor, Norman Lamont, ran a distinctly different income tax strategy from the current incumbents of 10 and 11 Downing Street. Recent research by the Institute for Fiscal Studies (IFS) sheds light on the notable disparities between their approaches.

THEN TO NOW…AND BEYOND

In 1991/92, basic rate income tax – then at 25% – was the top rate of tax paid by 96.5% of UK adults. The remaining select 3.5% paid higher rate tax (at 40%, as it is now outside Scotland). Up until the end of the 2000s, the starting point for higher rate tax generally followed inflation. However, in that period earnings outpaced prices, with the result that there was a steady rise in the numbers dragged into higher rate tax.

Matters worsened in the 2010s, with both freezes in the higher rate threshold and the introduction of additional rate tax on incomes over £150,000. The freezes stopped after 2015/16, only to reappear in the 2021 Budget. The Chancellor at the time, Rishi Sunak, fixed the higher rate threshold (again outside Scotland) at £50,270 through to 5 April 2026. At the time inflation was not projected to rise to the dizzy heights of 2% until 2025, meaning the impact of the freeze was expected to be limited.

In March 2023, Mr Sunak’s next but two successor as Chancellor, Jeremy Hunt, announced:

- a further two-year extension to the higher rate threshold freeze (outside Scotland), meaning it would run up to and including 2027/28; and

- a reduction in the threshold for additional rate tax (45% outside Scotland) from £150,000 to £125,140 (a move Scotland followed)

THE RESULT

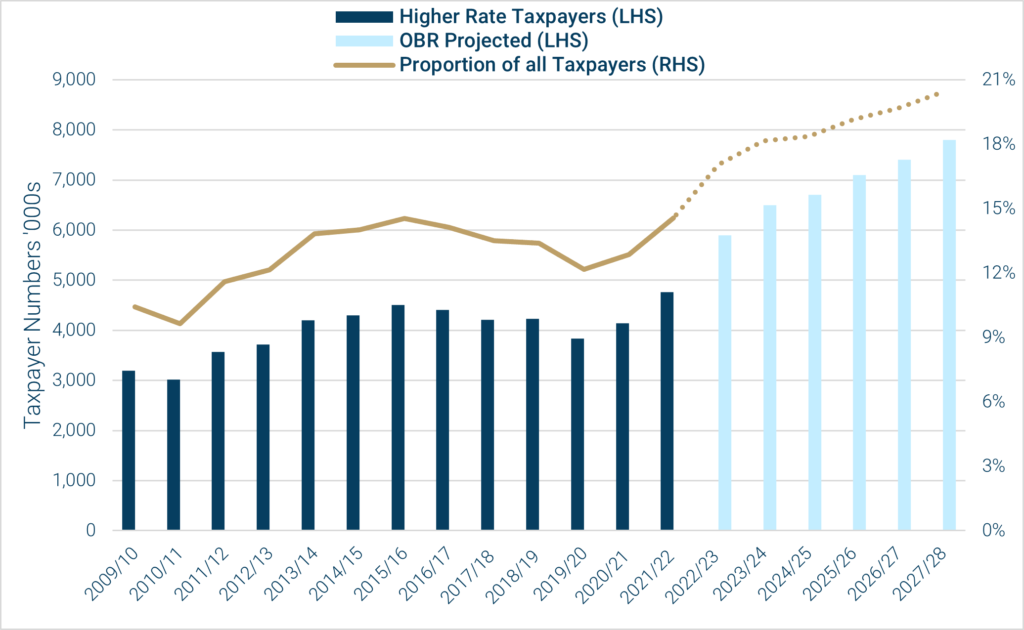

The IFS used data from the Office for Budget Responsibility (OBR) to calculate the impact of the Sunak and Hunt freezes combined with inflation at a level which was almost inconceivable just over two years ago. By April 2028, 14% of all adults and about one in five of all taxpayers will face a marginal rate of tax of 40% or more. The graph below shows the unhappy trend. In terms of tax increases, the IFS calculates that the threshold freezes will represent the single most significant tax increase since the rate of VAT was raised from 8% to 15% in 1979.

That only one number has changed – the additional rate threshold – makes the size of this tax increase difficult to believe…until you remember inflation. In effect, the Treasury has delegated tax policy to the soaring Consumer Prices Index (CPI).

WHAT CAN YOU DO?

If you pay tax at more than basic rate already, or are likely to in the next five years, there are a range of factors to discuss with your financial planner:

- What is your marginal rate of tax – the tax you pay on the next £1 of income?

It may not be either of the ‘advertised’ rates of 40% (42% in Scotland, 33.75% on dividends) or 45% (47% in Scotland, 39.35% on dividends). The labyrinthine structure of the UK tax system with tapered allowances and cliff edge eligibility thresholds can create much higher marginal tax rates. For example, if your income is between £100,000 and £125,140 your marginal tax rate could well be as high as 60% (63% in Scotland) - Are your investments held in the optimum framework, given your marginal tax rate?

You may have been dragged into a higher tax band because of the threshold freezes, in which case the way you hold your investments may need to be revised. Remember too that the dividend allowance has been halved to £1,000 this tax year and will halve again in 2024/25. You could soon be a dividend taxpayer, if you are not already - Can you take advantage of independent taxation?

Married couples and civil partners are taxed individually, so it might make sense to transfer investments if you each have different marginal tax rates - Can you restructure your income?

For instance, if you are a private company director you may be able to choose between dividends and salary and save tax - Are you making the most of the tax reliefs available on pensions and venture capital investments? The rules in both areas changed (yet again) in 2023/24, creating some new opportunities

As tax year end approaches, there is still time to take action that can have an impact on your 2023/24 tax bill.

If you would like to arrange a call with one of our financial planners, please contact us here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Share

Other News

What Happens Next After Selling Your Business?

Key Emotional, Financial, and Lifestyle Considerations

You’ve sold your business. The deal is done. Years — maybe decades — of work have led to this moment. So… what now?

Preparing For The Autumn Budget: What It Could Mean For Your Finances

The Autumn Budget is set for Wednesday 26 November 2025, when Chancellor Rachel Reeves will deliver her first full Budget statement.

Alongside the speech, the Office for Budget Responsibility will publish updated forecasts for the UK economy, giving us a clearer picture of the challenges and opportunities for the year ahead.

Using Lifestyle Modelling To Stress-Test Your Retirement Plan

Planning for retirement isn’t just about hitting a savings target — it’s about ensuring that the lifestyle you envision can be sustained throughout your later years.