How Stock Markets Perform After Heavy Falls

Share

With Italy on full lockdown and markets reeling from the effects of Coronavirus, investors around the world are not surprisingly considering their options when it comes to managing their investments.

As we continue to track events on a daily basis, leaning on up-to-date information to assist in our decision making, the truth is we still do not know the extent of the economic disruption the outbreak may cause. At present, the issue of containment is what is currently having the biggest impact in Western economies. Should restrictions be relaxed activity may recover but, again, it is too early to predict the outcomes at this stage.

To put the stock market falls into perspective, investors in developed markets who have reaped the benefits of a tireless bull market for the past decade, will merely have seen the tip of their returns skimmed off. Markets may also look to governments and central banks to assist in global recovery – interest rate and other tax cuts could be implemented, offering a helping hand to asset prices.

What next?

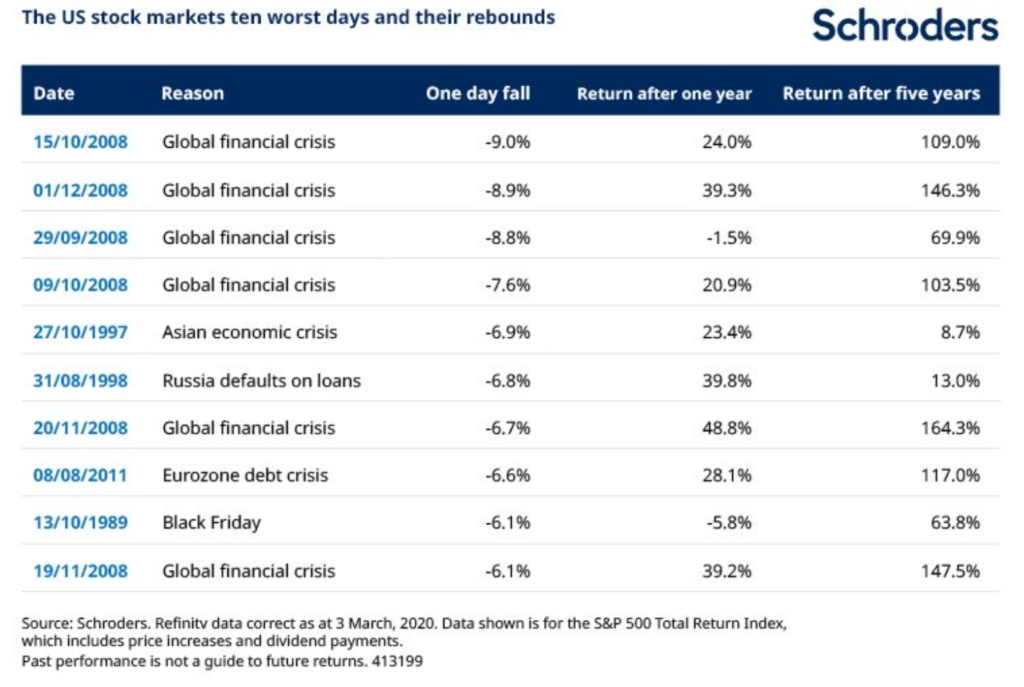

While markets have been quick to react, referring to past performance can offer investors a glimpse of potential things to come. For example, following a 6.7% fall for the S&P in November 2008, investors may have struggled to believe that an investment of $10,000 made that day would have grown to $26,400 within five years (before charges). That equates to a 164.3% return over the five-year period. Equally, the one day fall of 9.0% in October 2008 led to a 109% rebound over the next five years.

The US stock markets ten worst days and their rebounds

While the above returns are illustrative, the data underlines the historic resilience of shares over longer time frames, even following market shocks.

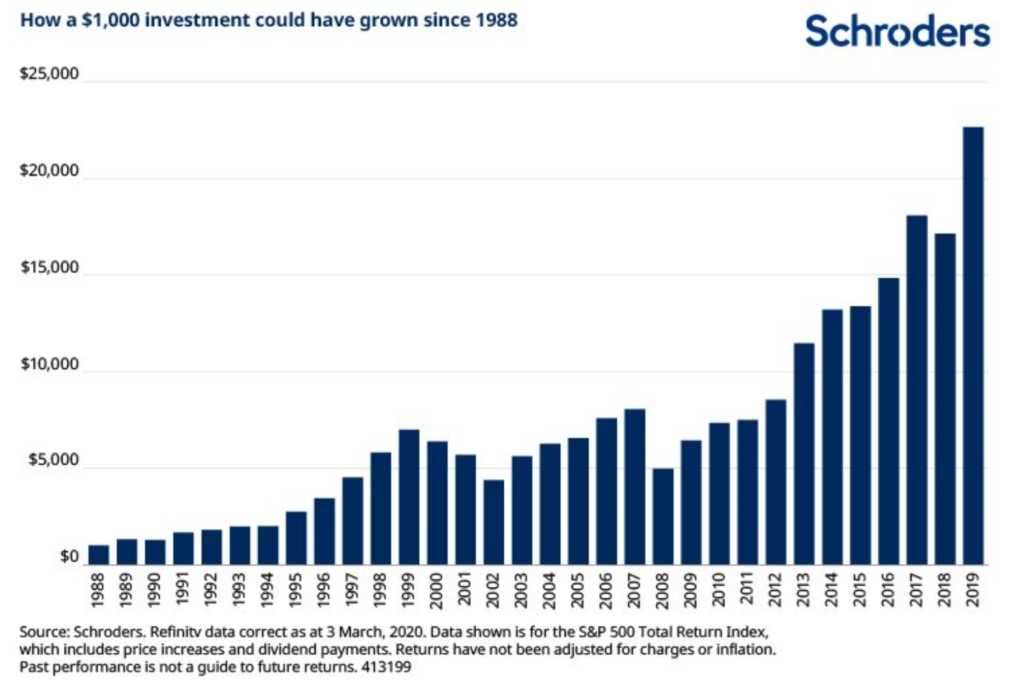

The chart below shows how a $1,000 investment in the S&P 500 at the end of 1988, left alone, could now be worth $22,678, not adjusted for charges or inflation. That’s an average annual return of 10.6%.

Past performance is not a guide to future returns. The chart is for illustrative purposes only and does not reflect an actual return on any investment.

Nathan Mead-Wellings, Director at Finura comments:

“Globally stocks have endured some of their worst performances since the financial crisis. However, history has shown that events such as this can trigger stocks to bounce back strongly over time. We have always encouraged our Clients to make their decisions rationally, not emotionally – good investment involves developing a long-term strategy and sticking to it”.

So, while historic patterns may not be repeated, they can offer some insight and reassurance. However, at this key stage in the outbreak, it would be remiss the dismiss the risks of the crisis until they can be fully quantified.

Johanna Kyrklund, Chief Investment Officer and Global Head of Multi-Asset Investment, says:

“Good investment is about cool-headed decision-making. The source of uncertainty will always be different but well-established investment processes are designed to cope with this…..For our daily routine, the only actual thing that changes is the amount of hand-washing. All is business as usual.”

For further details on how the coronavirus may affect the different asset classes, you can read the views of the various Schroders investment desks here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: https://www.schroders.com/en/uk/tp/markets2/markets/coronavirus-how-stock-markets-perform-after-heavy-falls/

https://www.schroders.com/en/uk/tp/markets2/markets/johanna-kyrklund-how-should-investors-act-in-a-crisis/

https://www.schroders.com/en/uk/tp/markets2/markets/coronavirus-the-views-from-our-investors/

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.