Incorporation and 25 percent corporation tax

Share

The advent of 25% corporation tax could make incorporation a less attractive option.

The arrival of higher rates of corporation tax for companies with taxable profits of over £50,000 is still more than two years away, but anyone considering incorporation now or in the near future would be well advised to check out the mathematics based on their expected circumstances.

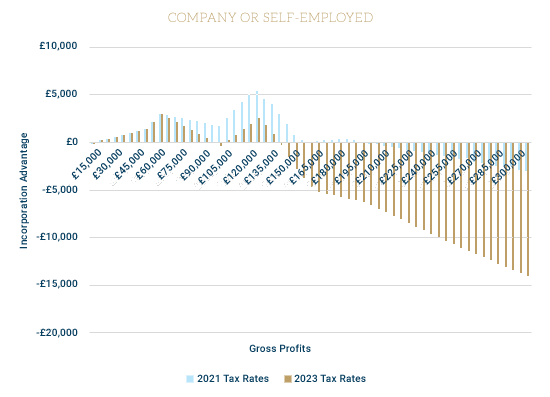

Looking at the numbers produces the following graph:

For the company calculations it is assumed that the director draws from gross profits a salary equal to the secondary national insurance (NIC) threshold (£8,840 in 2021/22), thereby sidestepping all NICs (employer and employee), with the balance of profits taxed at the appropriate corporation tax rate and then paid out in full as dividends (with the full £2,000 dividend allowance available). The mathematics brings out the following points:

- Up to about £58,840 of gross profits, there is no difference between 2021 and 2023 because, once the salary is deducted, the taxable profits do not exceed £50,000 so 19% corporation tax applies. The absence of NICs more than counters the combination of corporation tax (19%) and income tax (7.5% on dividends above the dividend allowance), meaning the corporate route produces the higher net income than self-employment.

- Between gross profits of £58,840 and £258,840 (above which the 25% applies to all taxable profits), the corporation tax rate is subject to what the HMRC policy paper describes as ‘marginal relief provisions’. Assuming this follows past practice, the implication is that a marginal rate of corporation tax of 26.5% will apply to taxable profits between £50,000 and £250,000. This shows in the graph as the red line (2023) starting to drop below the blue line (2021) at £60,000 of revenue.

- Once the 26.5% marginal corporation tax rate is hit above £50,000 of taxable profits (£58,840 gross profits), there is a £930 band of basic rate tax band remaining for the director before higher rate tax and 2% NICs kick in. The following then applies in the higher rate tax band:

| Self-employed £ | Dividend £ | |

| Gross marginal profit | 1,000.00 | 1,000.00 |

| Marginal corporation tax @ 26.5% | N/A | (265.00) |

| Dividend payable | N/A | 735.00 |

| NIC @ 2% | (20.00) | N/A |

| Salary | 980.00 | N/A |

| Marginal income tax @ 40%/32.5% | (400.00) | (238.88) |

| Marginal net income | 580.00 | 496.12 |

- In the additional rate band, a similar gap in favour of salary over dividends occurs while the 26.5% marginal rate applies:

| Self-employed £ | Dividend £ | |

| Gross marginal profit | 1,000.00 | 1,000.00 |

| Marginal corporation tax @ 26.5% | N/A | (265.00) |

| Dividend payable | N/A | 735.00 |

| NIC @ 2% | (20.00) | N/A |

| Salary | 980.00 | N/A |

| Marginal income tax @ 40%/32.5% | (450.00) | (280.04) |

| Marginal net income | 530.00 | 454.96 |

- Finally, once the 25% overall rate of corporation tax is reached, this is the picture:

| Self-employed £ | Dividend £ | |

| Gross marginal profit | 1,000.00 | 1,000.00 |

| Marginal corporation tax @ 26.5% | N/A | (250.00) |

| Dividend payable | N/A | 750.00 |

| NIC @ 2% | (20.00) | N/A |

| Salary | 980.00 | N/A |

| Marginal income tax @ 40%/32.5% | (450.00) | (285.75) |

| Marginal net income | 530.00 | 464.25 |

The overall result is that above about £59,000 of gross profits, the 2023 corporate route will be less attractive than its 2021 counterpart and worse than self-employment for gross revenue of above £140,000.

The blip in the graph between about £100,000 and £150,000 is because of the impact of personal allowance tapering. With no grossing up of dividends, it requires £91,160 of dividends plus £8,840 of salary before taper bites – equivalent to about £127,800 of gross profit. Once that happens on the corporate side the benefit drop off is sharper – which can be seen between £150,000 and £180,000 of revenue.

NB This exercise is looking only at the tax and NIC numbers. There will be many other factors (and costs) in the incorporation decision, e.g. the 130% super-deduction allowance is only available to companies.

For further advice on incorporating your own business, please contact us here.

Source: Techlink.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.