Inflation: Where Are We Headed?

Share

While daily Covid-19 figures continue to dominate headlines, another statistic is causing a stir around the globe; the topic of inflation and when will we see significant inflation coming through.

While some economists are warning that the currently rising inflation rate could be dangerous for the economy, on balance, the consensus seems to be that the increases will not last.

What is causing the rise?

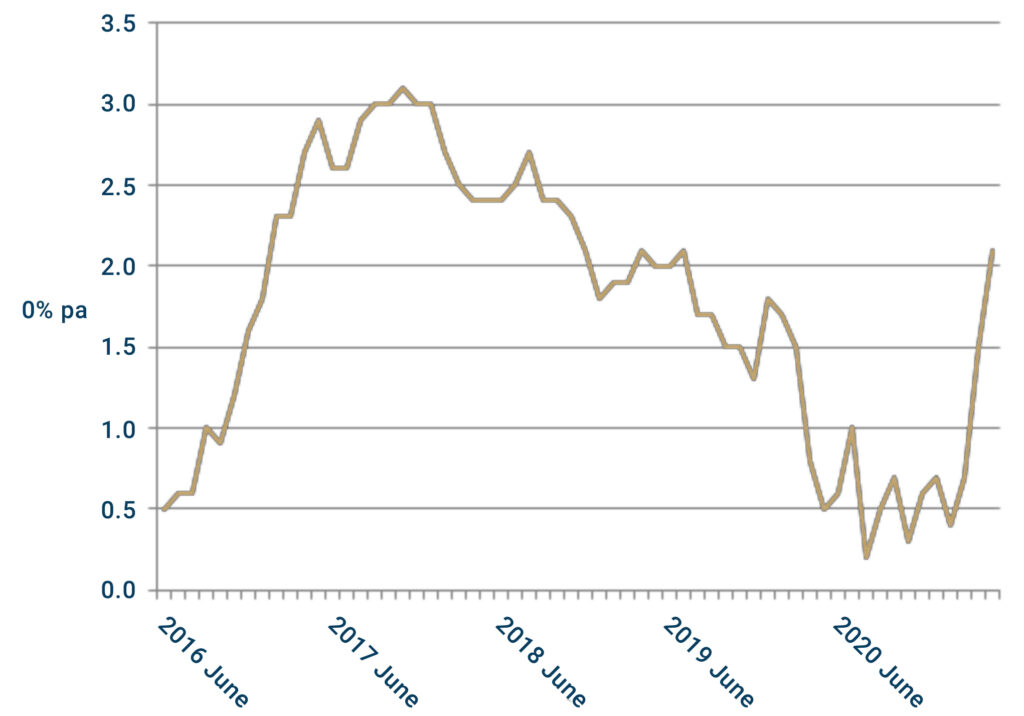

Alex Funk, Chief Investment Officer of investment partner Schroder Investment Solutions (SIS), suggests inflation is higher in the near term because of the rise in commodity prices and the impact of the re-opening of the service sector. The markets are for now taking the view that the inflationary spike is a transitory effect of the economic recovery. The Bank of England has forecast 2.5% inflation in the final quarter of 2021 but, looking further out, inflation is expected to keep on building as the output gap closes and capacity tightens at the beginning of 2022.

A May inflation rise was widely discounted, but the magnitude of the increase was greater than expected.

Source: ONS

What next?

Alex and his team feel that the recent increase in inflation is largely a consequence of the rise in commodity prices and the rapid pace of recovery which has created bottlenecks in some sectors of the world economy. Growth in 2021 will be the fastest in the 21st century (source: Schroders) and, while there is significant spare capacity, it cannot be put in place rapidly enough to prevent shortages of materials, parts and labour emerging in the short term.

The recovery in growth is being driven by a re-opening of the service sector and so favours the advanced economies over the emerging markets. Consequently, the upgrade is led by the US and Europe with only a minor increase in the emerging market forecast. The differential is reinforced by the greater availability of vaccines and fiscal support in the developed economies. Such an outcome is a contrast with the recovery from the last recession when massive stimulus in China led the emerging markets out of the global financial crisis (GFC). While it is thought that the current inflation spike will prove to be temporary, experts do see inflation picking up next year and the need for a tighter monetary policy from the US Federal Reserve (Fed).

As with any long-term investment strategy, the key is not to panic, a sentiment supported by the Bank of England governor who has warned against an over-reaction to rising inflation (source: BBC).

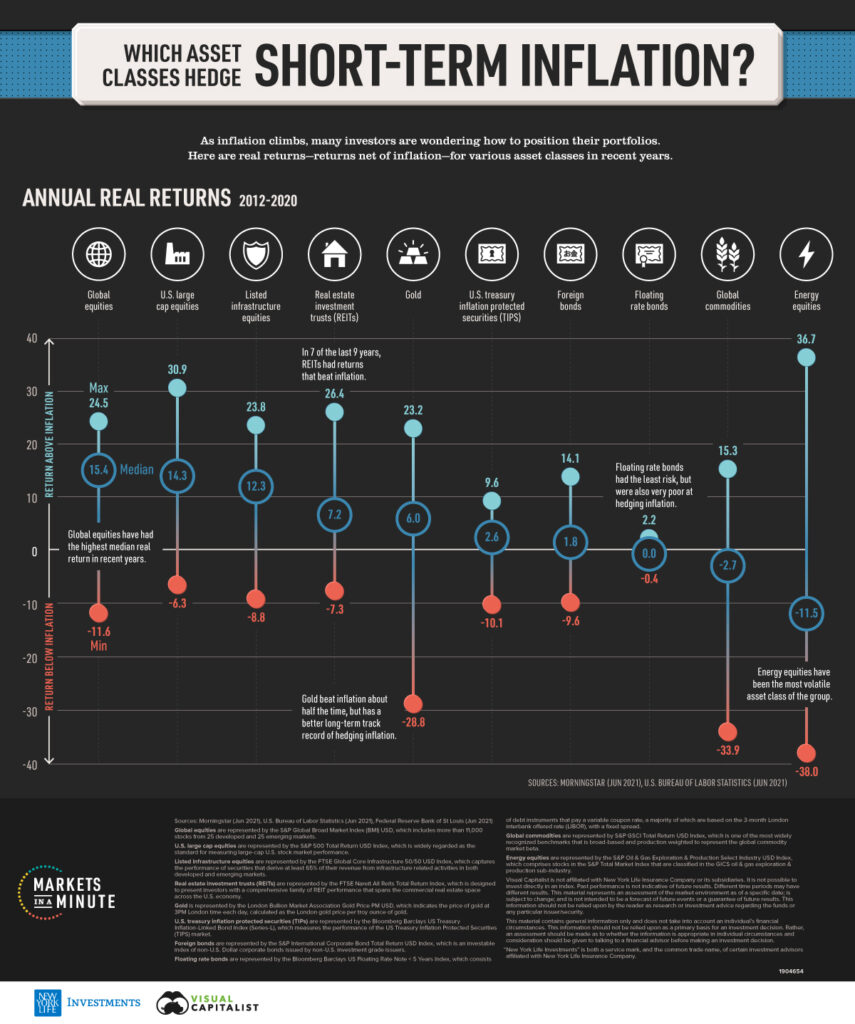

How can you hedge inflation?

While Alex will incorporate ‘best ideas’ into our SIS portfolios we thought a look back on those asset classes that have historically provided the best hedge against short term inflation would be interesting.

Source: Visual Capitalist

Part of our role at Finura is to ensure Clients select an investment appropriate for their risk profile and objectives and, along the journey, help them to tell the difference between temporary volatility and permanent loss. This will include factoring the impact of inflation on portfolios. However, if you are holding a significant amount of cash or low yield investments, we would encourage you to have a conversation with your financial planner, who you can contact here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources:

https://www.bbc.co.uk/news/business-57679371

https://advisor.visualcapitalist.com/which-asset-classes-hedge-against-inflation/

https://www.schroders.com/en/uk/private-investor/insights/economics/could-global-growth-this-year-be-the-fastest-this-century/

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.