Interest rates: a rise comes nearer

Share

The US and UK central banks have both hinted at rates rises being nearer than they had previously expected.

On 22nd September 2021, the US central bank, the Federal Reserve (Fed) went first. The Federal Open Market Committee (FOMC) repeated the statement it made after its July meeting that it had ‘…decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labour market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time’. However, on this occasion the Fed acknowledged that ‘…the economy has made progress toward these goals. If progress continues broadly as expected, the Committee judges that a moderation in the pace of asset purchases may soon be warranted’.

In layman’s terms, the central bank was accepting that inflation on its preferred metric was well above its 2% target (currently it is at 3.6%). The implication is that if the next set of employment numbers are satisfactory, when they appear on 8th October, the Fed will start to taper its level of quantitative easing (QE) from the current $120bn a month of bond purchases. The bet now is that at the 2-3 November FOMC meeting the Fed will announce that it will start tapering later that month or in December. This may seem a protracted announcement process, but the Fed has bitter experience of surprising the market with changes to QE and now is almost overly communicative.

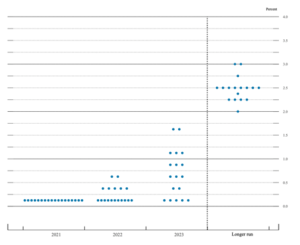

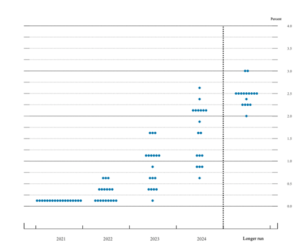

This was also the month that a new set of dot plots appeared (please see below), showing each Committee member’s assessment of future interest rates at the end of the current year, the next two years and the long term. The plot is as near as the Fed comes to a prediction of rate changes, although the Fed chair, Jay Powell, insists it should be viewed with “a big grain of salt’. The difference between the June and September plots was significant. Whereas in June, five members of the committee were expecting rates to remain unchanged from their current level in 2023, three months later only one person expected no change. Two fewer were expecting no change in 2022, making the committee evenly split on whether rates would come off the floor next year.

June 2021

September 2021

The Bank of England made its announcements the following day on 23rd October. It starts from a different position from the Fed:

- The latest round of QE bond buying is capped at £150bn, whereas the Fed’s bond buying is – so far – open ended. While two members of the Bank’s Monetary Policy Committee (MPC) wanted QE buying to stop now, £43bn short of the cap, the majority were in favour of continuing purchases. No doubt the Chancellor will be grateful, even if the Bank claims QE has nothing to do with Government financing.

- The Bank does not supply dot plots, although some commentators believe they would provide an interesting insight. However, the Bank’s statement pointed in the same direction as the Fed. While the MPC repeated its mantra that ‘some modest tightening of monetary policy over the forecast period was likely to be necessary’ this time around it also said that recent developments ‘appeared to have strengthened that case’. The major factor here is inflation, which is now 3.2% (on a different measure from the Fed’s), 1.2% over target. The overshoot prompted the usual exchange of letters between the Bank’s Governor and the Chancellor. Once more, the Bank has had to revise its estimates of where and when inflation will peak – the latest version is ‘slightly above 4% in 2021 Q4’. To this has been added the suggestion that Ofgem’s next updating of energy price caps, effective from April 2022, could see inflation ‘remain slightly above 4% into 2022 Q2, all else equal’. The ‘transitory’ nature of the inflation spike is growing ever less so.

Summary

The market thinks that the Bank of England is now likely to raise rates by early next year, which would potentially be before it had exhausted the latest round of QE (a point accepted by the MPC). A higher base rate could be a hard sell as there are signs that UK economic growth is slowing (e.g. the 0.1% GDP growth in July). The resultant increase in mortgage costs coming alongside energy price rises and next April’s national insurance (NIC) hikes hardly creates a combination to spur consumer spending, a key driver of growth.

If you would like to discuss the effect interest rates may have on your portfolios, please contact us here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: Techlink

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.