Investing to beat inflation

Share

With the latest figures released in mid-October, it is clear that inflation isn’t going anywhere soon.

The announcement for September saw prices rise by 0.4%, which brings the annual rate of inflation down ever-so-slightly to 8.2%. In the context of a target inflation range of between 2-3%, the current rate is still eye wateringly high.

With the Fed determined to bring it down through the hiking of interest rates, it is likely to continue to slowly come back down to earth. The problem is that this could take a while, and investors still need to generate returns in the meantime. However, there are several different investment assets that hold up well against inflation.

A little bit of inflation is often considered a good thing for the economy as a whole. Prices that are rising modestly encourages people to go out and earn more and invest their money and encourages companies to innovate and improve their businesses. This is because if your wealth or income stands still, it goes backwards in real terms slowly over time as prices rise around you.

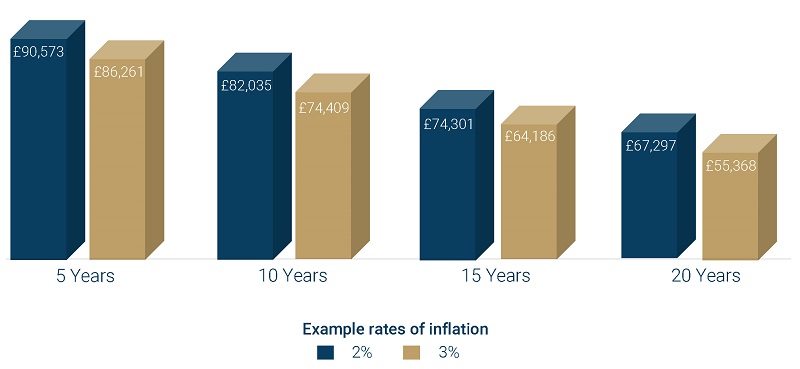

WHAT £100,000 COULD BE WORTH IN FUTURE YEARS

When inflation gets too high though, it puts pressure on household budgets and can reduce spending on certain things. The last year or two has been a perfect example of this. With the price of necessities such as gas, energy and food rising so much, many households have had to cut back on discretionary spending like electronic equipment, entertainment, and vacations. With less spending in the economy, companies generate lower revenues which in turn means they hire fewer people or even lay them off. This creates a negative spiral that puts the brakes on economic growth and is one of the reasons why the stock market has crashed this year.

There are a number of investments that can buck this trend when inflation is high. Now this isn’t to say that all of these will always outperform inflation. Different market cycles can cause volatility for different reasons, so, as always, the key is to diversify across the different assets available, rather than go all in on one or two. They also won’t necessarily grow at a rapid pace when inflation is high. In many cases, these assets are designed to simply hold their value rather than fall dramatically. For example, if the S&P 500 has dropped -25%, a return from another asset of -1% or +0.25% would be considered a very good result, even if it’s still below your long term target return.

One of, if not the oldest investment asset in the world, gold still retains its position as an inflation hedge in today’s modern economy. The history of gold as a store of value goes back to ancient civilizations like the Incas and the Egyptians. Even back then, humans realized that the scarcity and beauty of it made it a perfect commodity to be used for trade and wealth. The world might have moved on since then, but gold still forms a major part of the global economy. Countries still lean heavily on their physical gold reserves as security for their own global financial dealings.

For investors, there are several different ways to purchase gold as part of a wealth preservation plan. You can buy physical coins and bullion. This creates several problems, such as how to store it and insure it. Companies will store it for you, but that can be expensive. You can store it yourself, but you’ll need appropriate security, and many home insurance policies don’t cover gold. It’s not a straightforward process.

There are also financial products that can help. There are funds and ETFs which invest in gold, either by holding physical gold on your behalf or by investing in financial instruments such as gold futures. While gold is the most common inflation hedging precious metal, there are plenty of others that are considered investment grade as well. The most popular of these are silver, platinum and palladium. All these metals have a long history of use in jewellery, industrial applications and as stores of value. You can think of these as small cap metals compared to gold’s large cap. The price is often more volatile, but they can go through stages where they rise in price significantly. The issues for investors are the same as with gold. Holding physical amounts come with insurance and security challenges or require the trust and cost of a third-party security deposit. Again, like gold, there are funds and ETFs which can provide exposure without the need to install a fireproof safe in your house.

Also worth considering are commodities. These are resources that are used all around the world with a demand profile that doesn’t change much based on market conditions. Agricultural commodities such as wheat, wool and soybeans are some examples. Because we rely on these types of goods to meet our basic needs, the level of demand for them tends to stay stable.

While we can all cut back on vacations or sneakers, we are less likely to reduce our consumption of things like bread and vegetables. This means that prices for commodities fluctuate a lot based on the underlying rate of inflation, and there are a wide array of financial products such as futures and options based on the prices of commodities. Another major commodity is oil, which again is used in ways in our economy which are not impacted by inflation. While we grumble about the price of gas, we still have to fill up our cars to get to work.

As ever, if you have any questions, please contact your financial planner.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources: Techlink

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.