Investing Within Pensions: Is Time On Your Side?

Share

As the sun sets on our working years, the desire for a comfortable and worry-free retirement becomes ever more apparent.

A crucial aspect of securing a financially stable retirement is the early initiation of pension saving. In the United Kingdom, the Office for National Statistics (ONS) has provided alarming statistics highlighting the importance of early pension planning to meet the financial demands of retirement. This article by one of our Chartered Financial Planners, Gush Verdding, explores the significance of commencing pension savings early and delves into ONS data to understand the staggering amounts needed for retirement.

WHAT DOES THE DATA TELL US ABOUT PENSIONS?

According to the latest data from the ONS, the average UK household spends around £29,900 per year in retirement. Assuming a retirement period of 20 to 30 years, individuals may need a substantial sum to maintain their standard of living. As a general rule, you could take your annual expenses and multiply this by 25 or 30 providing a broad estimation to the size of the pot you may need to retire.

For instance, using the ONS’s average retirement expenditure, a retiree aiming for a comfortable annual income of £29,900 would require a pension pot ranging from £747,500 to £897,000. This significant amount emphasizes the urgency and significance of early pension saving.

THE EFFECTS OF COMPOUNDING

The key to accumulating a substantial pension pot lies in the power of compound interest and starting early. Compound interest allows your investments to grow not only based on your initial contributions but also on the interest earned over time. The earlier you start saving for your pension, the more time your investments have to grow and compound. Even relatively small monthly contributions in the early years could potentially yield significant returns in the long run.

EXAMPLES

Let’s consider an example. Assume two individuals, Rosie, and Greg, both contribute into a pension however Rosie contributes £250 per month for a period of 25 years, whilst Greg starts later and, as such, contributes £500 per month for a period of 15 years. Assuming a moderate annual return of 5%, here’s how their pension pots could differ by the time they retire:

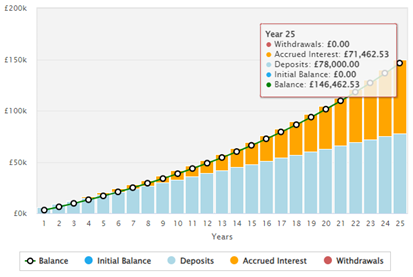

Rosie

- Rosie starts contributing £250 per month into her pension for a period of 25 years

- At the end of this period Rosie could have accumulated a pension pot of £146,462.53

- Total contributions amount to £78,000 with potential investment growth of £71,462.53

- This assumes a net growth of 5% per annum

Source: Compound Interest Calculator

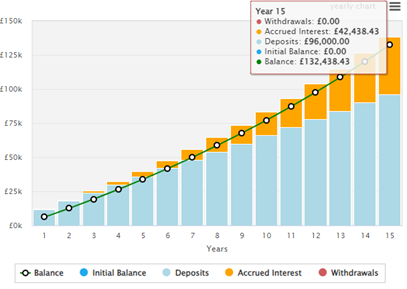

Greg

- Greg began contributing to his pension at a later point in his life and as such could only contribute for a period of 15 years, however he contributed double at £500 per month.

- At the end of this period Greg could have accumulated a pension pot worth £132,438.43

- Total contributions amount to £90,000 with potential investment growth of £42,438.43

- This assumes a net return of 5% per annum.

Source: Compound Interest Calculator

CONCLUSION

- Despite Greg contributing double in comparison to Rosie, Greg ends up with less pension savings due to his contributions starting later

- Greg contributes more into his pension but does not benefit from investment growth as much as Rosie, given the shorter timeframe for investment

| Rosie | Greg | |

| Contributions Per Month | £250 | £500 |

| Timeframe | 25 Years | 15 Years |

| Total Contributions | £75,000 | £90,000 |

| Investment Growth | £71,462.53 | £42,438.43 |

| Annual Growth | 5% | 5% |

| End Investment Value | £146,462.53 | £132,438.43 |

In conclusion, the importance of saving for a pension early cannot be overstated, especially in light of the ONS statistics highlighting the considerable amounts needed to sustain a comfortable retirement in the UK. Starting early harnesses, the power of compound interest, significantly increasing the potential for a substantial pension pot. By setting aside funds for retirement and investing wisely, individuals can secure a financially stable future.

If you would like a review of your pension plan, please contact one our financial planners here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources:

Office for National Statistics (ONS) – “UK population projections: 2018-based statistical bulletin.” (https://www.ons.gov.uk/peoplepopulationandcommunity/populationandmigration/populationprojections/bulletins/nationalpopulationprojections/2018basedstatisticalbulletin)

Office for National Statistics (ONS) – “Family Spending in the UK: financial year ending March 2021.” (https://www.ons.gov.uk/peoplepopulationandcommunity/personalandhouseholdfinances/expenditure/bulletins/familyspendingintheuk/financialyearendingmarch2021)

Money Advice Service – “How much money do I need to retire?” (https://www.moneyadviceservice.org.uk/en/tools/pension-calculator)

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.