ISAs: 25 Years On

Share

On 6 April 2024, ISAs reached the grand old age of 25.

When they first appeared, in April 1999, they were seen largely as a rebranding by the then Labour Chancellor, Gordon Brown, of two schemes introduced by his Conservative predecessors: Nigel Lawson (Personal Equity Plans – PEPs) and John Major (Tax Exempt Special Savings Accounts – TESSAs). Since that far off day, ISAs have undergone many changes.

A SUCCESS STORY?

The latest figures from HMRC show that, in April 2022, there was £742bn invested in adult ISAs, of which 38% was in cash ISAs and virtually all the rest in stocks and shares ISAs. On the face of it, that is an impressive figure – about 28% of the current total government debt.

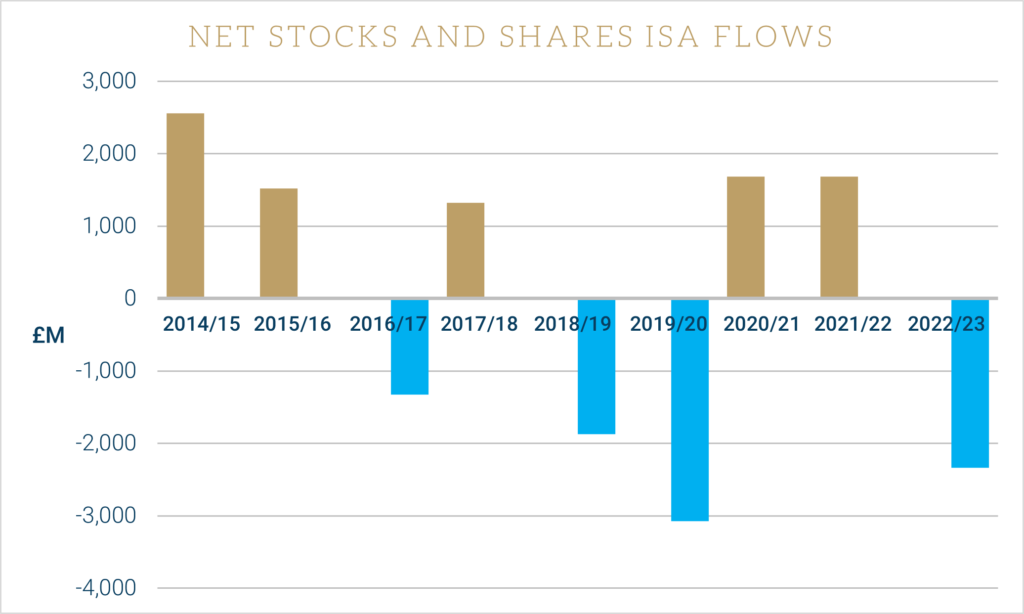

A different picture emerges from the timelier statistics published by the Investment Association (IA). Their data is less comprehensive, covering only stocks and shares ISAs of its members and the five large investment platforms. The IA also presents the ISA flows as a net figure, that is subscriptions in less amounts withdrawn. The results might surprise you:

Source: Investment Association March 2024

From April 2023 to February 2024 the IA recorded a net outflow of £4.7bn, although March 2024 will almost certainly see an inflow. The outflow from stocks and shares ISAs recorded by the IA has a parallel in cash ISAs, where the HMRC statistics show a £28.8bn drop in total investment value between April 2020 and April 2022.

THE CASE FOR ISAS NOW

Go back to May 2022 and, for many investors, ISAs offered little advantage over direct investment, a fact that helps explain the net outflows. Two years on, the changes to taxation explained elsewhere in this newsletter have brought new potential tax liabilities for many investors. Over the same period, the rise in interest rates from near zero to around 5% has meant many savers are no longer protected from tax by the frozen personal savings allowance (£1,000 for basic rate taxpayers and £500 for higher rate taxpayers).

The corollary is that the tax advantages provided by an ISA are now more relevant to investors and savers. As a reminder, within an ISA:

- All interest is free of UK tax;

- All dividends are also free of UK tax (although withholding tax may apply to foreign dividends);

- Capital gains are free of UK tax; and

- All HMRC reporting is handled by the ISA manager – you have nothing to put on a tax return.

The ISA subscription per tax year is £20,000 – the same as it has been since 2017/18. For a higher rate taxpayer investing in a UK equity income fund with a typical yield of about 4.5%, that could translate into a tax saving of over £300 a year, assuming their dividend allowance is already used elsewhere. There could also be capital gains tax savings – cumulative growth of more than 15% would be enough to create a gain above the 2024/25 annual exemption.

WHEN TO TAKE ACTION

Despite the focus on tax year end subscriptions, the optimum time to invest in an ISA is early in the tax year, to maximise the period of favourable tax treatment.

Talk to your Finura financial planner about your ISA options, both for new contributions and for making the most of existing ISAs. It might be time to transfer that old cash ISA which once offered such a good rate but is now classed as ‘closed to new investment’.

FOOTNOTE: THE UK ISA

As noted in on our previous article, one of the well-trailed non-surprises of the March Budget was the UK ISA. This is currently still at the consultation paper stage, so there are no firm details. It looks likely to have a maximum subscription of £5,000 per tax year (in addition to the normal £20,000 ISA limit) and to be restricted largely or entirely to shares and bonds issued by UK companies and, possibly, UK government bonds (gilts). Transfers will be restricted to prevent money leaking into ordinary stocks and shares ISAs.

These probable investment constraints have met with some criticism – the UK now accounts for less than 4% of the world’s stock markets by value. Give the election is on 4th July, there is no certainty that the UK ISA will become a reality.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Source: Techlink

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.