Modernising the Active vs Passive debate

Share

Traditional active versus passive debates have become quite stale. Advocates of each have entrenched views, not willing to consider the merits of the other side.

It is true that passive investing has been growing in the UK, more so the case in the US where it has been more established. And thus Advisers often ask whether they should choose active or passive for their clients. However the argument can be more nuanced than simply 100% active or passive. Many believe that some asset classes are better suited to active investing, whilst others feel passive is superior given the lacklustre track record of some active managers in particular asset classes.

Below is an example of how these questions may be answered via Parmenion’s new Conviction investment solution.

Passive fund management has now grown from 17% of the total in 2006 to 22% in 2013 (source: IMA Annual Survey: Asset Management in the UK 2013-14). This is likely to continue in the future given the greater awareness of costs and their drag on investment returns, putting pressure on active fund managers to justify their fees.

And today the scope and depth of passive offerings is exceptional. The range of ETFs and the indices they track is multi varied, providing an investor with an efficient way to track a return at low cost. Plus there is the rise of “smart beta”, funds that track a specific characteristic of an index e.g. small cap and value. Apart from low costs, the other tailwind for passive funds has been Quantitative Easing (QE) or “the printing of money”. Stock markets have been a major beneficiary of QE, the bull market in the UK has been in place since 2009. The objective of QE was to raise asset prices, making people feel wealthier and therefore up their spending, thereby encouraging economic growth.

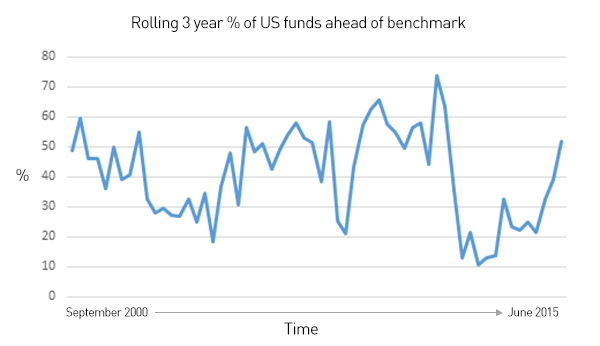

However QE is indiscriminate in terms of company share price. The active manager struggles in such an environment as both good and bad companies rise in price terms, providing less opportunity for the active manger to differentiate. This is illustrated by the fund managers in US Large Cap equity, often considered the most efficient stock market and thus the hardest to beat the index. In both the 2000-04 and 2005-09 periods, approximately 60% of active fund managers outperformed their benchmarks, whilst between 2010 and 2014 with QE in full flow this figure dropped to 22% (Source: Morningstar and the Boston Company). Thus with QE coming to an end in both the United States and UK, and with interest rate rises in prospect, the tailwind behind passives in these markets may be coming to an end.

The figures quoted above lead to an interesting question … just how many active fund managers do beat the market?

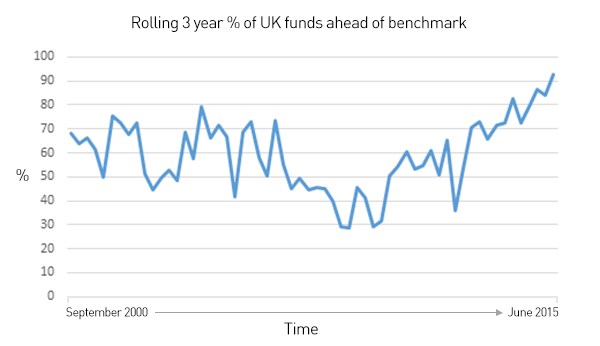

It is often quoted that only 20% of fund managers beat their benchmark, and then not always the same fund managers. It is true that certain markets favour the style of some fund managers at various points in time. However at Parmenion, our research shows that the above 20/80 statistic is very misleading. The number of active managers beating the index does vary over time and does differ between various markets. Take the chart below, this shows the percentage of fund managers in the UK All Companies sector, that on a rolling 3 years basis to each quarter end, are ahead of the index. The chart covers a 15 year period and shows the percentage varies from 30% to a staggering 93% over the 3 years to end June 2015.

(Source: FE Analytics)

Now look how the US equity (assumed to be the most efficient of all equity markets) differs from the UK. The swings in performance are wider and on some occasions the percentage of US fund managers who outperform is as low as 11%.

The above charts represent valuable information. Depending on the market, there are times when a high percentage of active fund managers are ahead of the benchmark. This provides opportunities to add value by increasing allocations to the active funds. Thus the chances of finding good fund managers who can beat the index increases. Conversely when the numbers are decreasing, it may be time to increase weightings to passives as the prospects of active funds is waning. It is this opportunity to flex weightings between active and passive within an asset class that is the basis of the new Parmenion Conviction solution. It solves the problem of whether to go 100% active or passive in either.

(Source: FE Analytics)

The solution offers a dynamic active/passive split with Parmenion Investment Management monitoring and controlling the mixture between the two. Hopefully it will provide the answer to the question Advisers often ask us!

First published on 31st July 2015 by Simon Brett of Parmenion Investment Management.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.