Pension Changes for the Tax Year 2020/2021

Share

While pension tax relief remained untouched in the recent Budget, there were several other key changes that may impact your pension plans for the forthcoming tax year.

Lifetime Allowance

The lifetime allowance is a limit on the amount of money you can withdraw from your pension – whether lump sums or retirement income – without triggering an extra tax charge called the lifetime allowance charge.

Every time a pay-out is made from your pension scheme, the value is compared against your remaining allowance to see if there is additional tax to pay. By adding up your expected pay-outs over time, you may be able to work out if you are affected. The value of your pension is calculated differently depending on the type of scheme you are in.

For this tax year, the lifetime allowance has increased from £1,055,000 to £1,073,000. In line with previous rules, savers can put as much as they wish into their pensions during their working life but, if it exceeds the lifetime allowance, hefty tax charges could be applied.

Any lump sum withdrawals over the allowance is taxed at 55%. Any amount you take as regular retirement income attracts a 25% charge.

There are various ways you can protect your lifetime allowance. Read more here.

Pensions Annual Allowance

Every year the government contributes billions into our pension pots by way of tax relief, which is provided at the highest rate of income tax that you pay. However, there is a cap on the amount on which you can earn tax relief each year, known as your annual allowance. For the 2020-2021 tax year, the allowance remains at a maximum of £40,000. Your allowance takes into account all contributions into your pension, whether that is by you, your employer or any third party.

Previously, if you earned more than £110,000, known as ‘threshold income’ and your adjusted income was more than £150,000 then your annual allowance started to fall. Your adjusted income is your total taxable income, including salary, rental income, savings interest, dividends and employer pension contributions. Prior to the 2020/21 tax year, for every £2 of adjusted income over £210,000, an individual’s annual allowance was reduced by £1, with the minimum annual allowance being £10,000.

In a move that was designed to ease the burden on some NHS workers from April 2020, both the threshold and adjusted incomes will rise, to £200,000 and £240,000 respectively but the maximum annual allowance for higher earners has been cut further.

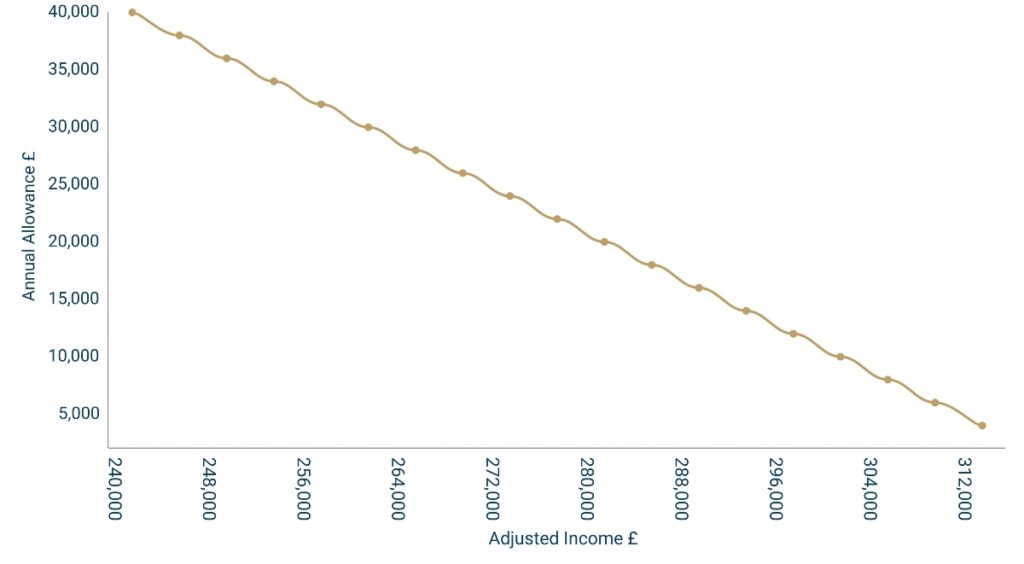

Where both the adjusted income and threshold income have been breached, the rate of reduction in the annual allowance is now £1 for every £2 that the adjusted income exceeds £240,000 with a minimum tapered annual allowance of £4,000. This results in an annual allowance of £40,000 for those with an adjusted income of less than £240,000; a reducing annual allowance for those with adjusted incomes between £240,000 and £312,000 and an annual allowance of £4,000 for those with an adjusted income over £312,000.

The graph below shows how the annual allowance decreases as adjusted income increases.

Once you have used your full allowance in a tax year, you can still ‘carry forward’ up to three previous years unused allowances. The carry forward facility applies on a rolling 3-year basis, so for 2020/21 you can use allowances from 2017/18, 2018/19 and 2019/20. Where the annual allowance is exceeded in the current tax year, it is the unused allowance from the earliest year that is used first.

At the end of every tax year, savers must calculate the aggregate pension input amount for all of their pension arrangements and compare this total to the annual allowance for that tax year – this will also include any available carry forward where eligible. The annual allowance charge is a percentage, levied on the pension input amount that exceeds the available annual allowance and liability for this charge rests with the saver.

The amount of the charge depends on the saver’s taxable income. In simple terms, the amount of the annual allowance excess is added to the top part of taxable income and must be repaid. It may be possible for the pension scheme to pay the charge, otherwise it will be collected by self-assessment.

State Pensions

The state pension will rise by 3.9% from 6 April 2020. The rise is thanks to the triple-lock system, which states that the pension must rise by September’s price inflation, average earnings growth or 2.5%, whichever is the greatest.

As a result, those who are entitled to the new full single-tier state pension will see their payments increase by £6.60 per week to £175.20, making them £343.20 better off by the end of 2021.

Meanwhile, the basic state pension will rise by £5.05 per week, translating into an annual increase of £262.60 (a total income of £9110.40 per annum).

If you would like to discuss any of the above changes in more details, please contact your Finura adviser.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Sources:

https://www.which.co.uk/news/2020/03/budget-2020-state-pension-to-increase-by-3-9-from-april-2020/

https://www.which.co.uk/money/pensions-and-retirement/personal-pensions/contributing-to-a-private-pension-explained/how-the-pensions-annual-allowance-works-ac8d33u9v9ch

https://www.moneyadviceservice.org.uk/en/articles/the-lifetime-allowance-for-pension-savings

https://www.pruadviser.co.uk/knowledge-literature/knowledge-library/annual-allowance/#

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.