The implications of the higher rate threshold freeze

Share

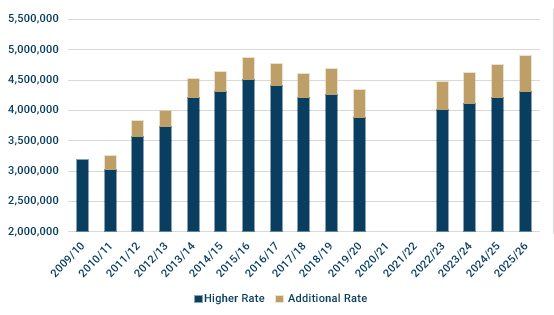

By 2025/26, one in six taxpayers could be paying above basic rate.

Cast your mind back to 2019 and the start of the Conservative Party’s contest to find a new leader. The headline of that first day was a proposal from one of the then many candidates to raise the higher rate threshold to £80,000. The candidate who put that idea forward went on to win the contest: Boris Johnson.

Last week’s Budget makes that £80,000 threshold appear even more distant than it did two years ago. Rishi Sunak, Mr Johnson’s second Chancellor (but the first to deliver a Budget) has parked the higher rate threshold at £50,270 from 2021/22 through to 2025/26. The freezing of the personal allowance and higher rate threshold will add nearly £8.2bn to the Treasury’s coffers by 2025/26.

More higher and additional rate taxpayers

NB No reliable numbers yet for 2020/21 and 2021/22 because of the pandemic.

Working through the numbers, Treasury papers and external research, some other facts emerge:

- By 2025/26 there will be 4.3m higher rate taxpayers and 591,000 additional rate taxpayers – a total of 4.9m in round numbers

- While that total is only marginally above the 2015/16 level (before the brakes were taken off the higher rate threshold), the population of additional rate taxpayers will be 63% higher

- According to calculations from the Institute for Fiscal Studies (IFS), 11% of adults (1 in 6 of all taxpayers) will be paying higher/additional rate by 2025/26

- The IFS also calculates that in inflation-adjusted terms, by 2025/26 the higher rate threshold will be worth about as much as it was in 1990/91 and around 20% less than in 2009/10

- One easy point to overlook is that the freeze locks in a permanent saving for the Treasury. So, even when/if indexation resumes in 2026/27, the four year freeze will continue to save the Exchequer £8bn+ a year because the future increases begin from a 2021/22 base

At the lower end of the income scale, freezing the personal allowance will drag 1.3m more people into tax by 2025/26 – a far cry from the last decade when Chancellors focussed on the numbers removed from tax.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Source: Techlink

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.