The Latest Lowdown on Interest Rates

Share

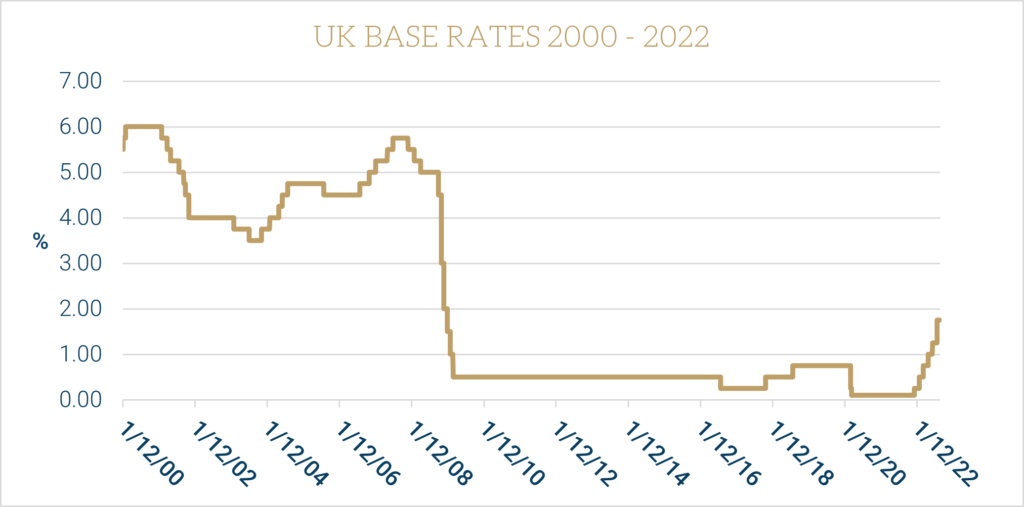

Interest rates in the UK have started to move upwards sharply. Until 16 December 2021, the Bank of England’s Base Rate was 0.1%. By early August 2022, after six consecutive increases, it was 1.75%. Across the Atlantic, over the same period, the USA central bank, the Federal Reserve, moved its main rate four times, from 0.00%-0.25% to 2.25%-2.50%.

Interest rates are rising

Source: Bank of England

Interest rates in the UK have started to move upwards sharply. Until 16 December 2021, the Bank of England’s Base Rate was 0.1%. By early August 2022, after six consecutive increases, it was 1.75%. Across the Atlantic, over the same period, the USA central bank, the Federal Reserve, moved its main rate four times, from 0.00%-0.25% to 2.25%-2.50%.

Why are interest rates rising so fast?

There is a one-word explanation of why the Bank of England and its counterparts around much of the world are raising interest rates: inflation. In the UK, CPI inflation reached 10.1% in July 2022; a year earlier it had been 2.0%, which just happens to be the Bank’s central target. In the US the corresponding figures were 5.4% and 8.5%, while in the Eurozone they were 2.2% and 8.9%.

Those jumps in the rate of inflation caught the central banks by surprise. At first the Bank of England, like its US and European counterparts, thought that the higher inflation would be ‘transitory’, a result of the supply chain difficulties that came with the end of COVID-19 restrictions. By the end of 2021 it became clear that waiting for the transitory spike to disappear was the wrong strategy and talk turned to interest rate increases, with the Bank of England making its first move just before Christmas.

The mistaken belief in transitory inflation explains why rates are now rising so rapidly. Had the central banks made the right call in summer 2021, they would have started pushing up rates back then. Now they are, to use a well-worn phrase of the economic commentariat, behind the curve. That means larger than normal rates increases are now needed to regain lost ground.

How high will rates go?

The Bank of England is avoiding any forward guidance on rates, preferring to adopt a common central bank mantra that it will be guided by the data. In part that is down to experience when guidance had to be abandoned when events did not unfold as expected.

Although the Bank is not offering any forecasts, in August the money market’s view was that the base rate will peak at 3% around the end of the year and then decline by 0.5% over the next two years. Whether or not the Bank thinks that picture is correct, it uses those market numbers as assumptions for its economic projections. At first sight 3% looks like a low peak, especially when The Bank of England forecasts that inflation will reach over 13% in the final quarter of 2022. However, economists are generally agreed that, after more than a decade of near-zero rates, the days of double-digit rates have long since passed. A further factor is that the Bank’s central projection is that inflation will fall sharply after 2023 and be back at 2% in two years’ time.

How higher interest rates affect your finances

The Bank of England’s action is focused on short term interest rates, but longer-term interest rates have also risen. For example, the benchmark ten-year UK Government bond offered a return of 0.97% at the end of 2021. By early August 2022, the same bond had seen its price fall to the point where the yield was just over 2%. Rising interest rates at all terms have several effects:

- The most obvious is that mortgage rates are rising. If you have a fixed rate mortgage, like five out of six borrowers, you will be unaffected until your fixed rate expires. As most fixed rate mortgages have terms of two and five years, one estimate is that, within the next two years, about 40% of borrowers will have to replace their fixed rate loan, probably at a higher rate, or fall back on their lender’s standard variable rate (SVR). SVRs have already followed the base rate upwards

- Deposit rates are rising, with the best instant access accounts now paying around the current base rate. Unfortunately, many deposit takers have seen the higher rates as an opportunity to increase their profit margins. You can still find High Street names offering a miniscule 0.01% on easy access deposits of less than £50,000 (and only 0.1% above). National Savings and Investments have increased their rates, but they remain relatively unattractive – for example, the once highly popular Income Bond now pays 1.2%, 0.55% below the base rate. Higher interest rates are not a reason to increase the amount you hold on deposit. The hard truth is that, at a time of high and rising inflation, deposits are a guaranteed way to lose buying power

- The rise in long-term rates has led to a marked increase in annuity rates, which are underpinned by long term fixed interest securities. The mathematics of annuities means that the increases have been significant. For example, based on a 65-year old, today’s rates are nearly a third higher than those available early last year

Summary

Higher interest rates cannot be ignored: they could leave you richer or poorer – or both. If you would like to discuss the challenges and opportunities rising rates present for your finances, please contact your financial planner here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

Your home may be repossessed if you do not keep up with payments on your mortgage.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Source: Techlink.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.