Time in the Market, not Timing the Markets

Share

We have all been told to ‘follow our instincts’ at some point in our lives but, when it comes to our finances, research has shown that going against what comes ‘naturally’ could help you achieve your long-term financial and lifestyle goals faster.

Buying low and selling high is every investor’s goal. And when markets fall the temptation is to sell to avoid further losses. However, timing the market is notoriously difficult and, allowing our emotions to cloud our decisions, could cost us dearly.

At Finura, one of our core approaches to financial planning is to use behavioural finance techniques to help our clients uncover the drivers behind their financial decision making. This can be achieved by assisting clients in understanding their investor personality.

By helping clients to gain a better understanding of the behavioural thoughts, feelings and emotions that drive their financial decision making, we empower them to make rational financial decisions that put analysis ahead of instinct, and thus reduces their likelihood of making choices driven by impulse.

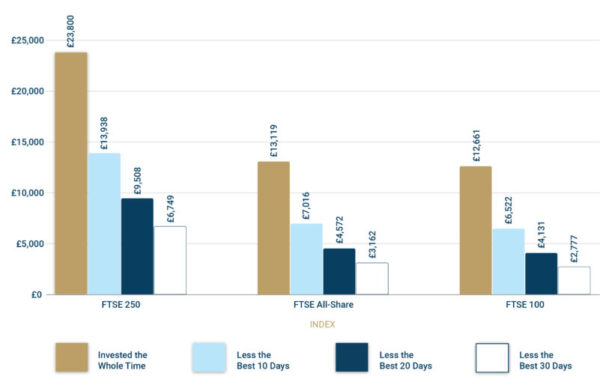

Research from Schroders* has shown that, over three decades, mistimed decisions on an investment of just £1,000 could have cost more than £17,000 in returns.

For example:

If you invested £1,000 in the FTSE 250 at the start of 1988 and left it alone for thirty years, the investment could have been worth £23,800 by the end of 2018.

If, however, you had tried to time your entry in and out of the market during those thirty years, and subsequently missed out on the index’s best thirty days, your investment might now only be worth £6,749. This is £17,051 less (not adjusted for the effects of charges or inflation.)

Below are the different % annualised returns you could have achieved based on how many of the index’s best days you may have missed by opting to move your money in and out of the market.

- 11.1% if you stayed invested the whole time

- 9.1% if you missed the 10 best days

- 7.8% if you missed the 20 best days

- 6.6% if you missed the 30 best days

While a 2% difference in between being invested in the FTSE 250 the whole time and missing the best ten days may seem small, the effects build up over time and could have cost you nearly £10,000. Also, historically, according to Schroder’s research, many of the stock market’s best days have followed some of the worst,

The below chart illustrates what your £1,000 invested in 1988 could be worth now across three different indices, based on staying invested the whole time or missing the 10, 20 or 30 best days.

Nathan Mead-Wellings, Director at Finura, comments: “We would all like to think that any money we choose to invest will earn us decent returns but, what all investors should know is, we are ultimately at the mercy of where we are in the current market cycle and that there will almost certainly be periods of both volatility and stability. At Finura, we encourage our clients to take a long-term view on their financial plans, and to assist them in not letting periods of poor performance cloud their decision making.”

* Research based on the performance of three indices affecting the UK Stock Market – the FTSE 100, the FTSE 250 and the FTSE All-Share.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.