Why are UK investors so optimistic about returns?

Share

As human beings, one of our natural traits is to take our experiences of the past and use these as the basis for decisions we make in the future. In the context of investing, we’re are regularly warned that past performance is not a guide to future performance and may not be repeated, yet recent above average gains have given some investors cause to adopt unreasonable expectations for their future portfolio performance.

With interest rates having remained at low levels for a decade since the financial crisis, and inflation also remaining low, it may seem surprising that investors have not adjusted their expectations downwards too.

However, research published in the Schroders Global Investor Study (GIS) 2017, found that more than half (58%) of UK investors are expecting to make average returns of up to 10% over the next five years and just under a third (31%) expect a minimum of 10% a year. The study, which surveyed 22,100 investors from 30 countries, also reported that those born in the UK during the eighties and nineties, i.e. millennials, were even more optimistic, with 43% expecting a minimum return of 10% per annum, and almost a quarter (23%) expecting more than 15%.

Yet, according to the Schroders Economic Group forecast, the reality is that UK equities are only expected to return 5.4% over the next seven years, or 2.4% a year once inflation is taken into account.

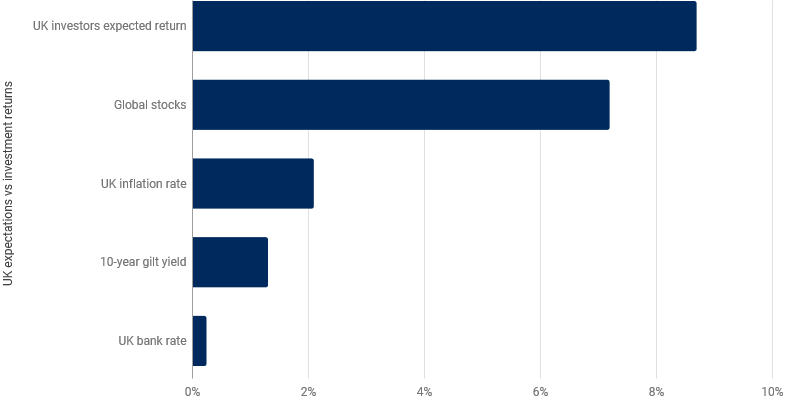

Below is a chart comparing how UK investor expectations compare to real world returns.

Source: Schroders Global Investor Study 2017, Thomson Reuters Datastream and the Bank of England. Global stocks is the annual total return MSCI World Index between 1987 and 2017. UK inflation is based on the Consumer Price Index averaged out over the last five years. 10-year gilt yield and UK interest rate are current as at 20 October 2017. Past performance is not a guide to future performance and may not be repeated.

With the study also highlighting that UK investors are currently averse to taking too much risk due to international political and economic uncertainty, just why are investors being so optimistic about returns?

James Rainbow, Co-Head of Schroders UK Intermediary Business, thinks that confidence is likely to have been buoyed by the strong performance of the UK stock market over recent years. Global synchronised growth, combined with low inflation and interest rates, drove stocks to new highs in 2017 – emerging markets provided a 30.4% return, North America 20.6% and international stocks a gain of 17%. Not surprisingly, investor optimism rocketed. However, Rainbow also comments that much of this performance has been the result of extreme actions taken by the central banks to stimulate the economy.

Return expectations are also said to correlate to age – Schroders GIS revealed that investors aged 18-35 are by far the most optimistic (11.7%), followed by 36-50-year olds expecting 9.8%, the 51-69 age group expecting 8.6% and those aged 70 and over an 8.1% return.

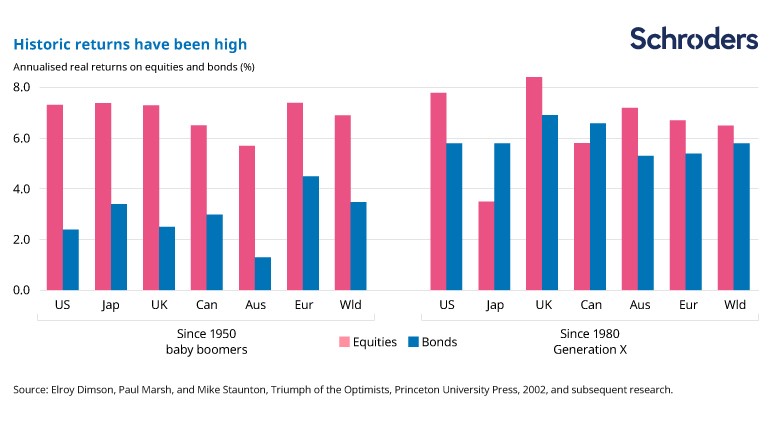

The chart below is also a good indicator of why the younger generations are much more positive in their outlook – high returns are not such a distant memory. The key thing here is to take into account that these are real returns (adjusted for inflation), as inflation was particularly high during the late 1970s and early 1980s, whereas it’s considerably lower now.

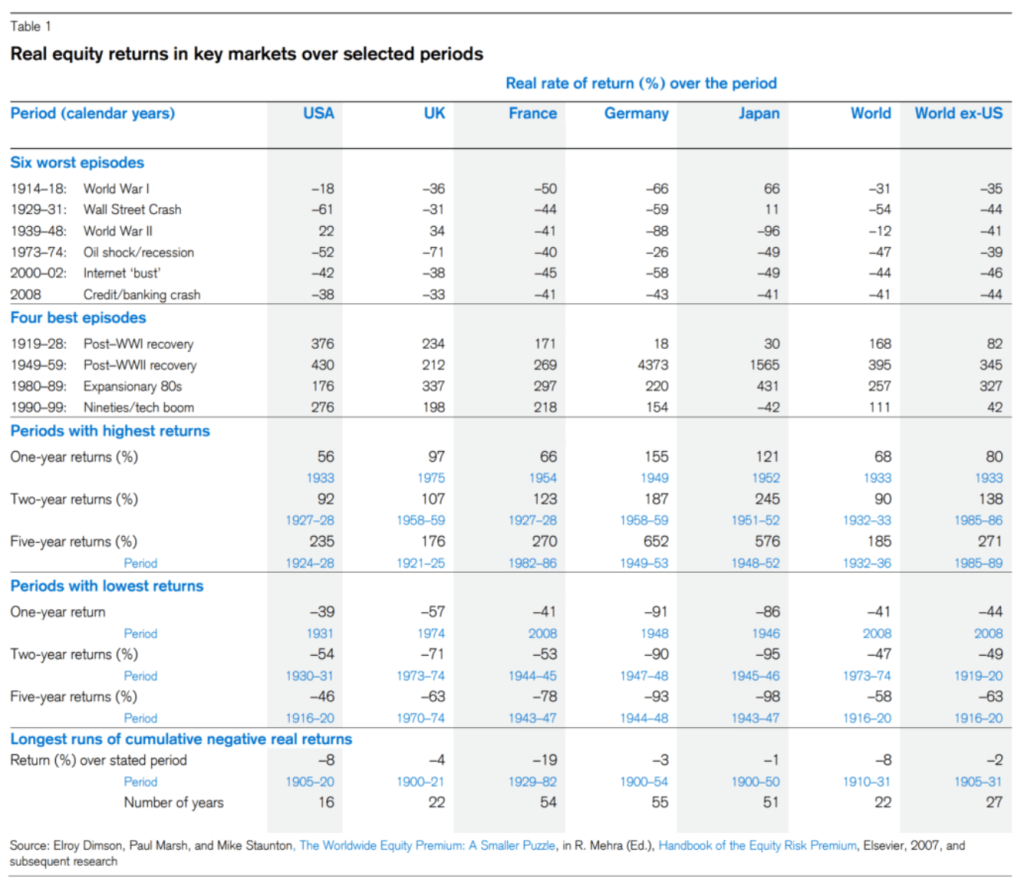

Regardless of what’s happening in investors’ portfolios today, one thing that will never change is that the market is always going to experience peaks and troughs and it all depends on where we are in the cycle. As the chart below from the annual Credit Suisse Global Investment Returns Yearbook (2018) shows, there have been some clear ups and some equally evident downs, and the returns we experience will be at the mercy of how markets are performing during the time we have our money invested.

Many people still refer to the financial crisis like it was yesterday – something that perturbing is hard to forget – yet it happened almost a decade ago. Markets have worked to correct themselves, but volatility and financial cycles will always exist. It’s up to us and our financial advises to align our expectations with what happening in the markets right now.

Sources:

http://www.schroders.com/en/uk/private-investor/insights/global-investor-study/uk-investors-expecting-returns-of-8.7-over-the-next-five-years/

https://www.investmentexecutive.com/newspaper_/focus-on-products/expecting-too-much/

http://www.schroders.com/en/uk/tp/markets2/markets/why-are-investors-so-optimistic-about-returns/

https://finalytiq.co.uk/lessons-118-years-capital-market-return-data/

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.