What Might 2023 Hold?

Share

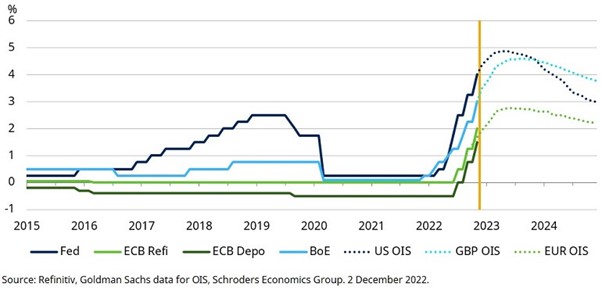

The re-opening of economies after Covid meant strong demand met limited supply, causing inflation to rise sharply. Higher interest rates are the most conspicuous result – and they are likely to persist in 2023 before dropping the following year – but they are just one facet of the key macro trends we expect to define the coming years as we move into a new economic regime.

In partnership with the Economic and Investment teams at Schroder Investment Solutions (SIS), as well as using data from Visual Capitalist, we take a look at key themes that we predict will drive the direction of the global economy this year and what they mean for investors.

You can also click here for an infographic overview of what the year might hold.

INFLATION

As the top economic story of 2022, inflation would seem the logical place to start. Following the re-opening of economies post-Covid, strong consumer demand met limited supply, driving inflation up sharply and sparking a phenomenon not experienced for decades by investors.

Central banks were slow to react, blaming unpredictable factors such as the war in Ukraine for the temporary spikes in energy and agriculture prices. With inflation at its highest level in some 40 years, they have been left with little choice but to play catch up and prioritise controlling inflation over focusing on growth, even if that means causing a recession.

In short, the scale of inflation means that interest rates have to rise further in the short term and stay higher for longer, which will put economic growth on the back burner for the foreseeable future.

How central banks have responded to inflation:

FISCAL INTERVENTION

Experts predict that governments will continue to adjust their taxation and spending policies, as they try to support businesses and households throughout the economic downturn. With large post-Covid deficits sitting on government balance sheets, rising interest rates are piling on the pressure for governments to apply austerity. However, there are many countries which oppose this approach, instead preferring a policy of increased spending. Either way, any fiscal stimulus risks stoking inflation, opposing the actions of central banks, which may also come under further fire as politicians’ feelings towards higher interest rates become more prominent.

EAST VERSUS WEST

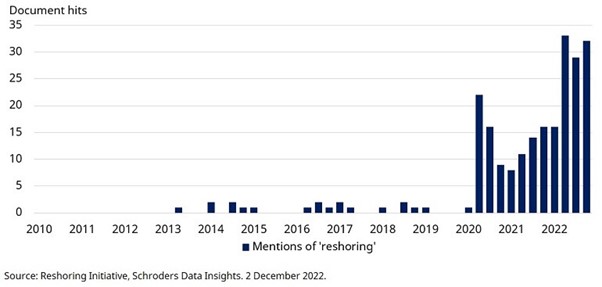

As the world’s second largest economy, events in China have a major impact on the global economy. Severe Chinese lockdowns during the pandemic caused widespread supply chain blockages (particularly in technology), adding to inflation and increasing the strain on the already fragile political relationship between China and the West. The impact of the war in Ukraine also widened geopolitical fault lines, as it triggered a reshape of the global energy landscape and threatened a greater divergence between the two parties.

In response, companies are seeking ways to diversify their production processes, with many choosing to relocate closer to home. This means one of the greatest deflationary forces of recent decades, the growth of low-cost production in China, is weakening and may have run its course.

Increased talk of bringing production back home:

Over in the US, friction continues with China over the video app, TikTok, with experts predicting that regulators will either ban the app altogether or force the sale to an American entity. The row began a few years ago, when Donald Trump accused the video-sharing social networking service of being a threat to national security, claiming its Chinese parent company, ByteDance, would give the Chinese government access to user data upon request, an accusation TikTok denies.

TECHNOLOGY

Jobs being displaced by automation is far from a new theme. However, experts predict that artificial intelligence (AI) will impact people’s lives in a much more tangible way in 2023, as AI start-ups force big tech companies to innovate faster, and employees discover new ways to use AI-powered tools to ramp up productivity as means of offsetting rising production costs caused by higher commodity prices and higher staffing costs.

Labour shortages are also taking their toll on profit margins, with curbs in migration tilting the power of wage negotiations back towards the workforce, as are rises in taxation, both of which are driving up the cost and prices of production in the near term. In response, experts believe businesses have one clear route to increase productivity – technology – using robots and AI where feasible.

ENERGY & CLIMATE CHANGE

The global system that supplies us with energy is extremely complex due to the volume of unpredictable factors that can affect its stability, most notably the impact of global conflict. Following the invasion of Ukraine, the UK is seeking to diversify its energy imports away from Russia, whilst brewing conflicts in Iran could also have a knock-on effect on the energy industry this year.

As businesses worldwide continue to widen their energy sources and transition to renewable energy, inflation is being driven structurally higher in a number of ways.

- 1. By the cost to create the required capacity

- 2. By the higher initial cost of switching to a more expensive source of energy and;

- 3. By the costs imposed through regulation to force the switch

On a more positive note, the threat from climate change will prompt greater investment in technological solutions which, if successful, could help lower the inflationary impact and improve the outcome for economies worldwide.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Source: Visual Capitalist and Schroders.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.