Who Should Be Responsible For Mitigating Climate Change?

Share

We can all ‘do our bit’ when it comes to caring for the environment. Recycling more, buying food from sustainable sources and reducing our carbon footprint. We all have a personal choice about where and with whom we spend our money.

But, when it comes to our investments, are the companies we are investing in also playing their part? In the latest Schroders Global Investor Study, results from over 23,000 investors across 32 locations worldwide revealed some interesting insights into investors’ views on how companies behave and who should be responsible for mitigating climate change.

The behaviours investors care about most

It is likely that the impact of COVID-19 has played its part in how investors responded this year – since the pandemic really start to take its toll, it has been widely acknowledged that a sustainable recovery plan was going to be needed.

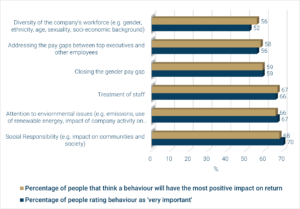

Interestingly, the behaviours people deemed to be the most important from a sustainability perspective are also considered the most impactful on returns.

Figure 1: Most important company behaviours vs most positive impact on return

Source: Schroders

Who do people think should be responsible for mitigating climate change?

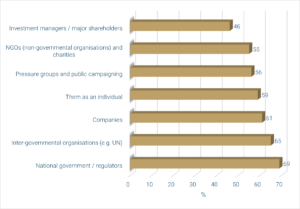

Questions have been asked about what Covid-19 could teach us about tackling climate change. The results show a wide spread of opinion on who needs to take responsibility, with a collaborative approach between all parties thought to be the best chance of making the biggest difference.

Figure 2: Who should be responsible for mitigating climate change?

Source: Schroders

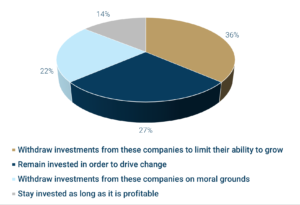

And what about Fossil Fuels?

While the above results show less than half of investors feel investment managers should be responsible for climate change, nearly 60% think they should withdraw from funds in the fossil fuel industry.

Figure 3: What should companies do about those involved in the fossil fuel industry?

Source: Schroders

Overall, the findings suggest that while investment professionals are not explicitly blamed for carbon emissions levels, they are expected to become more involved in reducing them. However it is also important for investors to understand the credentials of their own investments, to ensure they align to their own values.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.