Words of Advice from the Financial Greats

Share

To call something “timeless” implies that it’s reach and impact has nothing to do with the passing of time and that it is just as good or true now as when it was created.

In the context of finance and investment, there are a number of financial greats who have imparted their wisdom that has stood the test of time.

Below are five investment quotes every investor should know and here is an infographic from New York Life Investments demonstrating the data that made them timeless.

NB: whilst some of the examples are quoted in $, the principles apply in any currency.

1 Warren Buffett

Classical economics assume that decision-making is entirely logical whereas, in reality, emotions and bias, amongst other factors, play a huge part. For example, in the first quarter of 2020, investors traded 10 times as much as they did in the same period in 2009. It is said that volatility, stock price strength and bonds vs stock performance are the three fear indicators that drive these trading spikes.

At Finura we have always encouraged our Clients to consider the role that emotions play in their financial decisions and we do this using the principles behind Behavioural finance. Behavioural finance applies psychology to economics and finance to understand how people really make financial decisions and answer how and why different behaviours may be impacting their financial decisions.

Finura have created a tool which will allow you to analyse your own investment personality, gain insight into your potential biases and see how you compare to other. Visit https://www.finura.co.uk/iq/ and share the findings with us.

2 Benjamin Graham

The key here is to recognise the difference between an investor and a speculator. The former being ‘focused on safety of principal and reasonable return’ and the latter ‘at risk of losing potentially the entire principle’.

Graham says we should think of an investment like having a partial ownership in a business; when investors think like an owner, they look for the intrinsic value of the company in the long-term, which can compound in value over time. As the below table shows, the investor is earning $231 on a $200 monthly contribution a few years later.

| Time | Monthly Contribution | Annual Return | Interest Earned on Investments |

| Year 1 | $200 | 7% | $14 |

| Year 11 | $200 | 7% | $231 |

3 Mellody Hobson

Mellody became president of Ariel Investments aged just 31 and she is also the chairwoman of Starbucks.

Investing early certainly paid off for Mellody and, given today’s inflationary environment, starting early is especially timely.

Here is an example of a potential benefit of starting early:

| Investor | Contribution Timeline | Monthly Contribution | Annual Rate of Return | Total Contribution Amount | End Portfolio Value |

| Investor A | Age 25-35 | $200 | 7% | $24,000 | ~$300,000 |

| Investor B | Age 35-65 | $200 | 7% | $72,000 | $245,000 |

As the above table shows, Investor A contributed just a third of what Investor B did over their lifetime but, by starting 10 years earlier, ended up with a higher portfolio value.

4 Ken Fisher

This is something that we have always stood by at Finura (read more here) and is best demonstrated with an example.

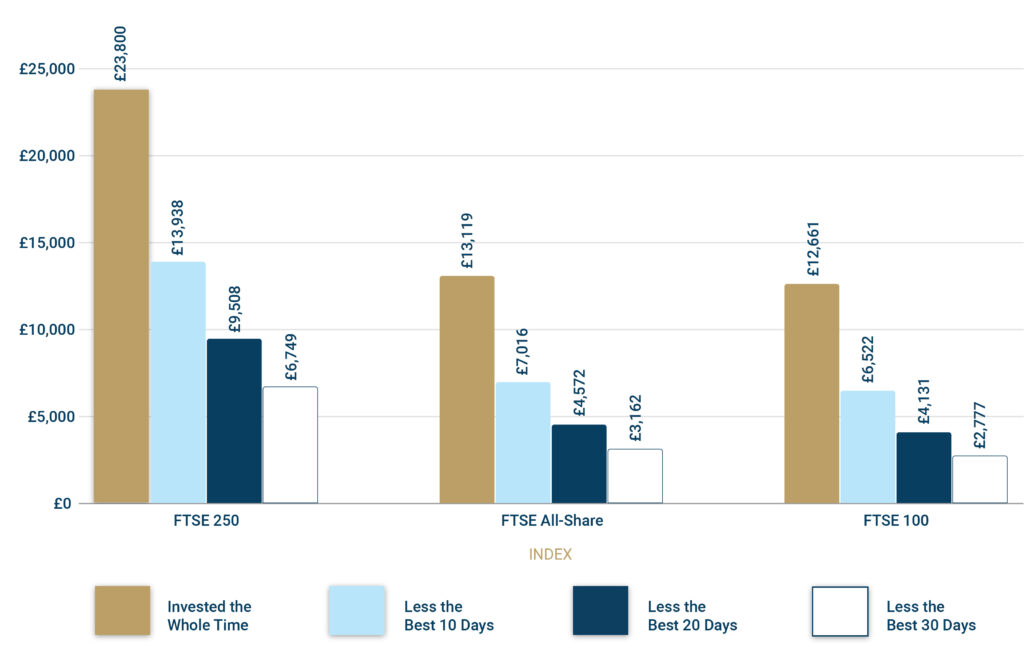

If you invested £1,000 in the FTSE 250 at the start of 1988 and left it alone for thirty years, the investment could have been worth £23,800 by the end of 2018. If, however, you had tried to time your entry in and out of the market during those thirty years, and subsequently missed out on the index’s best thirty days, your investment might now only be worth £6,749. This is £17,051 less (not adjusted for the effects of charges or inflation.)

The below chart illustrates what your £1,000 invested in 1988 could be worth now across three different indices, based on staying invested the whole time or missing the 10, 20 or 30 best days.

The most important thing to remember during times of volatility is that the market, as a whole, has a very long history of recovering from downturns.

5 John Maynard Keynes

It has become increasingly difficult to generate consistently positive returns by investing in just one market.

By following the below key principles from those who have shaped the financial world, investors can potentially position themselves for better portfolio success.

- React logically, not emotionally

- Leverage compound interest

- Start early

- Stay invested

- Diversify

If you would like to open a conversation about your investment plans, please contact us here.

Articles on this website are offered only for general information and educational purposes. They are not offered as, and do not constitute, financial advice. You should not act or rely on any information contained in this website without first seeking advice from a professional.

Past performance is not a guide to future performance and may not be repeated. Capital is at risk; investments and the income from them can fall as well as rise and investors may not get back the amounts originally invested.

![]() You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

You are now departing from the regulatory site of Finura. Finura is not responsible for the accuracy of the information contained within the linked site.

Source: Visual Capitalist

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.