How to rebalance our expectations of investment returns

Share

In our previous article, we discussed how many investors are expecting higher than average returns, despite the current economic uncertainty and consistently low interest rates. We would all like to think that any money we choose to invest will earn us decent returns but, what all investors should know is, we are ultimately at the mercy of where we are in the current market cycle and that there will almost certainly be periods of both volatility and stability.

With forecasters suggesting that future returns will be below UK investors’ average expected returns of 8.7% over the next five years, how can we adjust our expectations to avoid being disappointed?

Firstly, we can look at where we are in the current cycle – inflation is expected to remain low, which means a smaller yield premium is being demanded by bond investors to compensate for the erosion of buying power caused by inflation. Secondly, although slowly on the rise, interest rates are expected to remain low; this is due to a variety of factors, including a slowdown in the growth of the working population and moderating expansion in some emerging economies. As a result, with cash savings not working as hard as they used to, investors may need to switch to higher risk asset classes to reach their desired goals.

Whilst 2017 finished strong, it’s important not to become avaricious; stocks that may have risen recently wont necessarily continue that path as valuations will begin to re-align themselves. It’s also wise to spread your investments across a diversified portfolio and to plan when you may want to change your strategy – it’s never wise to make snap decisions amidst market volatility so use periods of stability to decide what you would do if things don’t go to plan.

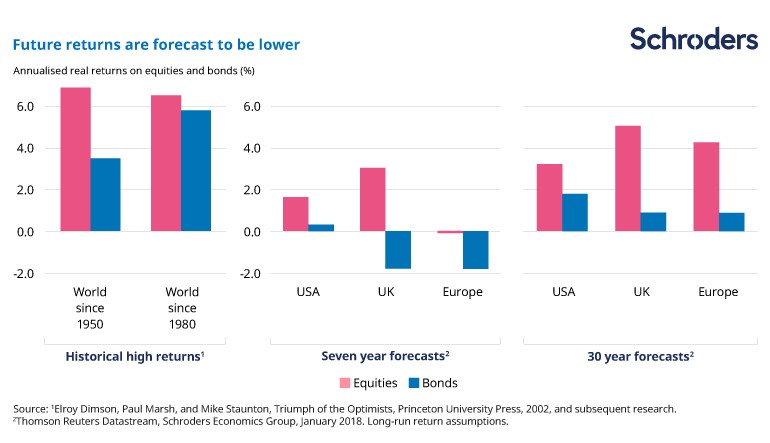

Below is a chart that compares historic returns with the latest long-run returns predicted by the Schroders Economic Group. As we can see, equity market returns enjoyed in the past are not expected to be repeated in the USA, UK or Europe over the both periods, with bonds faring worse, providing negative returns over seven years in the UK and Europe and marginal positive returns across all regions in the 30-year forecast.

Another way to better manage our expectations is to understand what kind of investor personality we are. At Finura, we commit time to understanding the behavioural thoughts, feelings and emotions that drive our client’s financial decision making and use this insight to develop solutions that put analysis ahead of instinct. Without knowing it, we are all subject to biases and prejudices, many of which are unseen and a function of our subconscious – our mind can play tricks on us more than we realise, making us believe that we are thinking analytically when we are in fact acting instinctively.

Alongside their Global Investor Study, Schroders have developed investIQ, a short test developed by behavioural scientists that helps us to understand our investment personality. It uses day to day scenarios and questions to ascertain how we make our decisions – it’s also developed with humour, helping to bring the investment world to life even for those with little or no investment experience.

Sources:

http://www.schroders.com/en/uk/private-investor/insights/global-investor-study/uk-investors-expecting-returns-of-8.7-over-the-next-five-years/

https://www.investmentexecutive.com/newspaper_/focus-on-products/expecting-too-much/

http://www.schroders.com/en/uk/tp/markets2/markets/why-are-investors-so-optimistic-about-returns/

http://www.schroders.com/en/uk/tp/markets2/markets/three-coping-strategies-for-a-mature-bull-market/

Share

Other News

Finura in the Spotlight: Shortlisted for Multiple Awards

Finura has an exciting few months ahead, as we wait to see the outcome of a number of short listings in different awards categories. MONEY MARKETING AWARDS – Advice firm of the year The winners will be announced on 12 September 2024 at The Londoner Hotel in London https://moneymarketingawards.co.uk/2024/en/page/shortlist-2024#adviser MONEYAGE AWARDS – Financial Adviser Award: […]

5 Tips For Parents With Children Heading To University

Starting university can be a challenging transition, but with a few lifestyle changes and careful planning, it can be a much smoother and enjoyable experience.

Empowering Yourself For Your Future: The Importance Of Lasting Powers Of Attorney (Property And Financial Affairs)

Life is unpredictable and unforeseen circumstances can sometimes leave us incapable of making decisions about our own affairs. That’s where a Property and Financial Affairs Lasting Power of Attorney (LPA) comes into play.